A Crypto Analyst Predicts a Potential Bitcoin Pullback After Failing Key Support Level

A well-known crypto analyst has suggested that Bitcoin (BTC) could experience a retracement after failing to maintain a crucial support level.

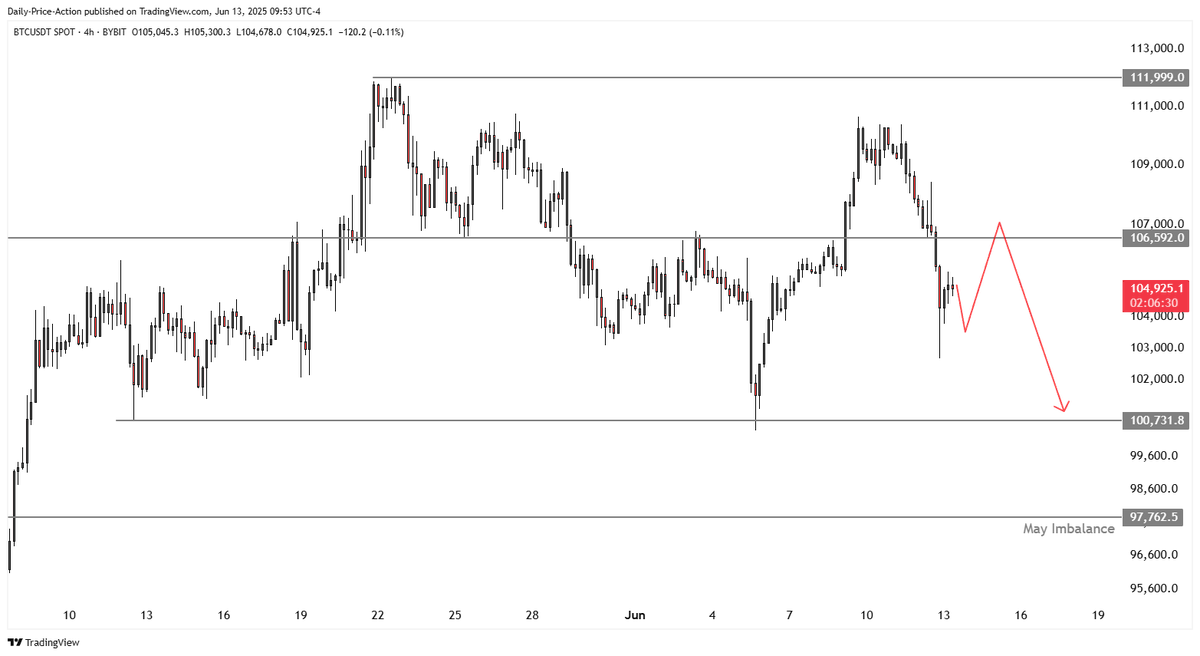

Justin Bennett, a prominent crypto trader, shared his insights with his 116,000 followers on X, a popular social media platform, indicating that BTC might revisit the lower end of a trading range around the $100,000 mark following a potential bounce over the weekend.

“In light of Thursday’s failure at $106,600, a plausible scenario for BTC could involve a pullback/consolidation on Friday, a weekend rally (typical retail behavior) towards $106,000-$107,000, and a subsequent revisit to the $100,000 support. A sustained break above $107,000 on high time frames would invalidate this thesis… Personally, I’m inclined towards short positions given the recent loss at $106,600, but I’ll consider going long if BTC presents a bounce opportunity.”

Bennett also pointed out that BTC whales are shifting from long to short positions, contributing to the weakening of the leading cryptocurrency.

“Whales were actively shorting during Thursday’s retail-driven surge. It was essentially a manipulated pump for BTC from the outset.”

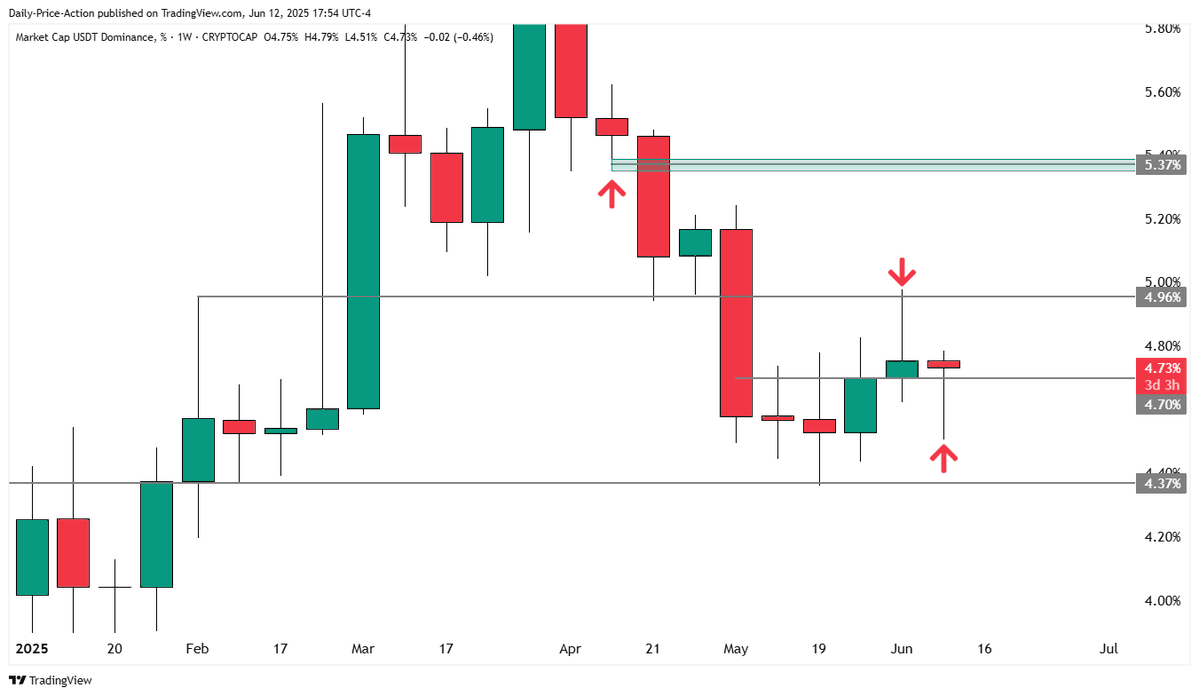

Additionally, the analyst raised concerns about the USDT dominance chart (USDT.D) potentially signaling bearish implications for Bitcoin.

Market participants closely monitor the USDT.D chart as it reflects the proportion of the total crypto market cap represented by the stablecoin USDT. A rising USDT.D chart typically implies a bearish sentiment for Bitcoin and other cryptocurrencies as traders may be offloading their crypto assets in favor of the stablecoin.

“While it’s premature to make a definitive call, the USDT.D weekly chart seems to be aligning for a resurgence towards 5%. I’ll await Friday’s two-day close for confirmation, but the outlook appears promising. (Tether dominance moves inversely to BTC and ETH).”

As of the time of writing, Bitcoin is trading at $105,658, marking a 1.6% decline over the past 24 hours, while USDT.D stands at 4.79%.

Stay updated by following us on X, Facebook, and Telegram. Subscribe to receive email alerts and keep track of price action with The Daily Hodl Mix.

Generated Image: Midjourney