The Hong Kong Government Approves Use of BTC and Ethereum for Immigration Applications

The Hong Kong government has recently made a groundbreaking decision to accept Bitcoin (BTC) and Ethereum (ETH) as valid assets for immigration applications. This move signifies a shift towards a more crypto-friendly economy in the region.

The decision to approve the use of these cryptocurrencies for immigration applications comes after two successful cases where applicants from mainland China used their crypto holdings as proof of assets in their residency applications.

One such case involved a client who successfully applied for investment immigration using HK$30 million worth of ETH as proof of assets. In another instance, an applicant was approved after presenting their Bitcoin holdings as financial proof. These cases mark the first instances of cryptocurrencies being accepted by the Hong Kong Investment Promotion Agency for such applications.

Hong Kong’s Pro-Crypto Economy

Under Hong Kong’s investment immigration program, applicants are required to demonstrate at least HK$30 million (approximately $3.85 million) in assets. Once approved, they must invest this amount within six months, traditionally in stocks or other regulated assets. Successful applicants initially receive a two-year visa, followed by a renewal process in a 2-2-3 cycle to gain permanent residency.

While Hong Kong’s move is a first for its investment immigration program, Singapore has long accepted cryptocurrency as an asset certificate for similar applications. However, applicants in Singapore are required to prove the initial source of funds used to acquire their crypto holdings.

According to reports, the Investment Promotion Agency deliberated internally for a month before granting approval for the first Hong Kong application involving cryptocurrency. Two additional applicants are currently awaiting approval based on their crypto assets, which must be stored on major exchanges or in cold wallets to meet Hong Kong’s criteria.

Retail Crypto Activity Surges in APAC, Surpassing US and Europe

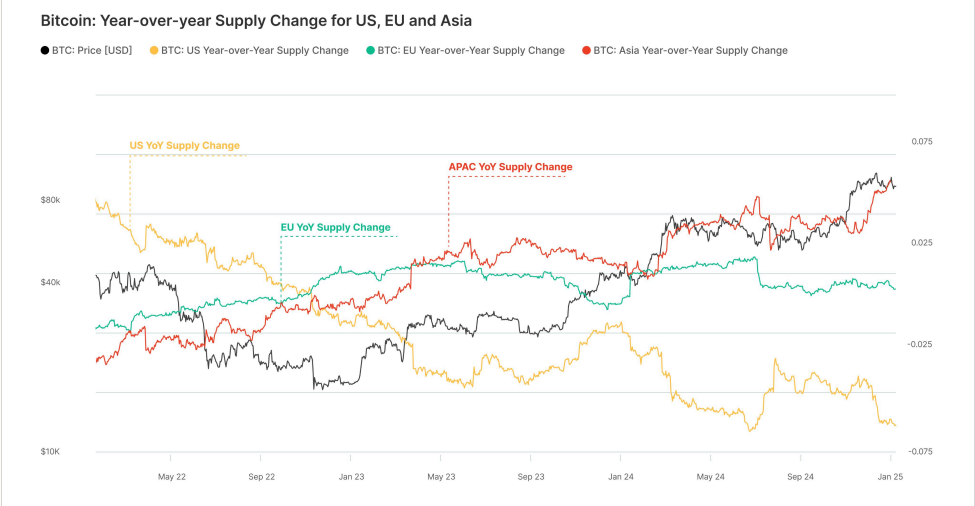

A recent report from Gemini, in collaboration with Glassnode, highlighted the surge in retail Bitcoin transactions in the Asia-Pacific (APAC) region, surpassing activity in the US and Europe. The report focused on retail engagement, excluding exchange-traded fund (ETF) activity and large institutional flows where the US leads.

The report indicated that retail engagement in APAC is expanding at a significantly higher rate, with the region experiencing a 6.4% year-over-year increase in Bitcoin supply since December 2022. In contrast, the US saw a 5.7% decline, while Europe recorded a minimal drop of 0.7% over the same period.

Saad Ahmed, head of Gemini’s APAC business, attributed the growth in retail engagement in the region to clearer regulations in key Asian markets like Singapore and South Korea. These regulations have encouraged individual investors to participate more actively in the crypto markets.

APAC BTC supply change chart. Source: Gemini 2025 Crypto Trends Report