Analysis: Aave Accumulation by Whales and Investors Hints at Potential Price Movement

- On-chain metrics suggested short-sellers could fuel selling pressure

- The $343 and $365-levels represented areas of selling pressure for AAVE’s price

In the midst of significant market volatility, Aave (AAVE) has been a focal point for long-term holders, investors, and whales as they appear to be accumulating the token. Recent data indicates a notable surge in accumulation, potentially signaling a bullish sentiment among large holders.

Millions of Dollars Worth of AAVE Accumulation

Renowned crypto expert Ali recently shared on X (formerly Twitter) that crypto whales have acquired $62 million worth of AAVE tokens in the past three days alone. Alongside this accumulation, a single whale was reported to have amassed 11,663 AAVE tokens, valued at $3.93 million, according to blockchain transaction tracker Lookonchain.

Given this substantial accumulation by whales and investors, the current market conditions may present an opportune moment to consider buying AAVE tokens.

Traders’ Bearish Bets

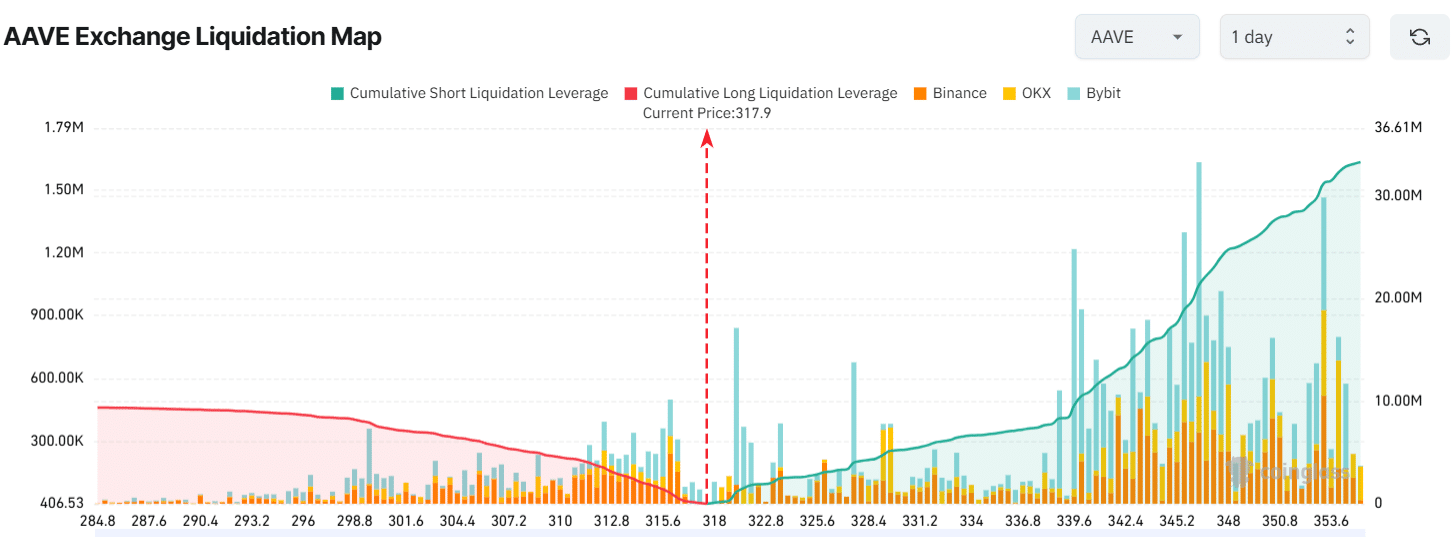

In contrast to the accumulation trend, intraday traders are actively taking short positions. Data from Coinglass indicates that short-sellers are heavily positioned at the $320, $327, $340, and $345 levels, holding $21.33 million in short positions. This dominance of short-sellers could potentially lead to selling pressure and further price depreciation.

Source: Coinglass

These findings underscore the bearish sentiment prevailing in the market, with short-sellers potentially exerting significant influence on AAVE’s price trajectory.

Despite the accumulation by whales and investors, AAVE’s price faces challenges amid the broader market sentiment. With major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) trading sideways, AAVE has struggled to gain momentum.

At the time of writing, AAVE was hovering around $320, with a modest 0.45% price increase in the past 24 hours. However, trading volume surged by 70% compared to the previous day, indicating heightened interest from traders and investors.

Technical Analysis and Key Levels

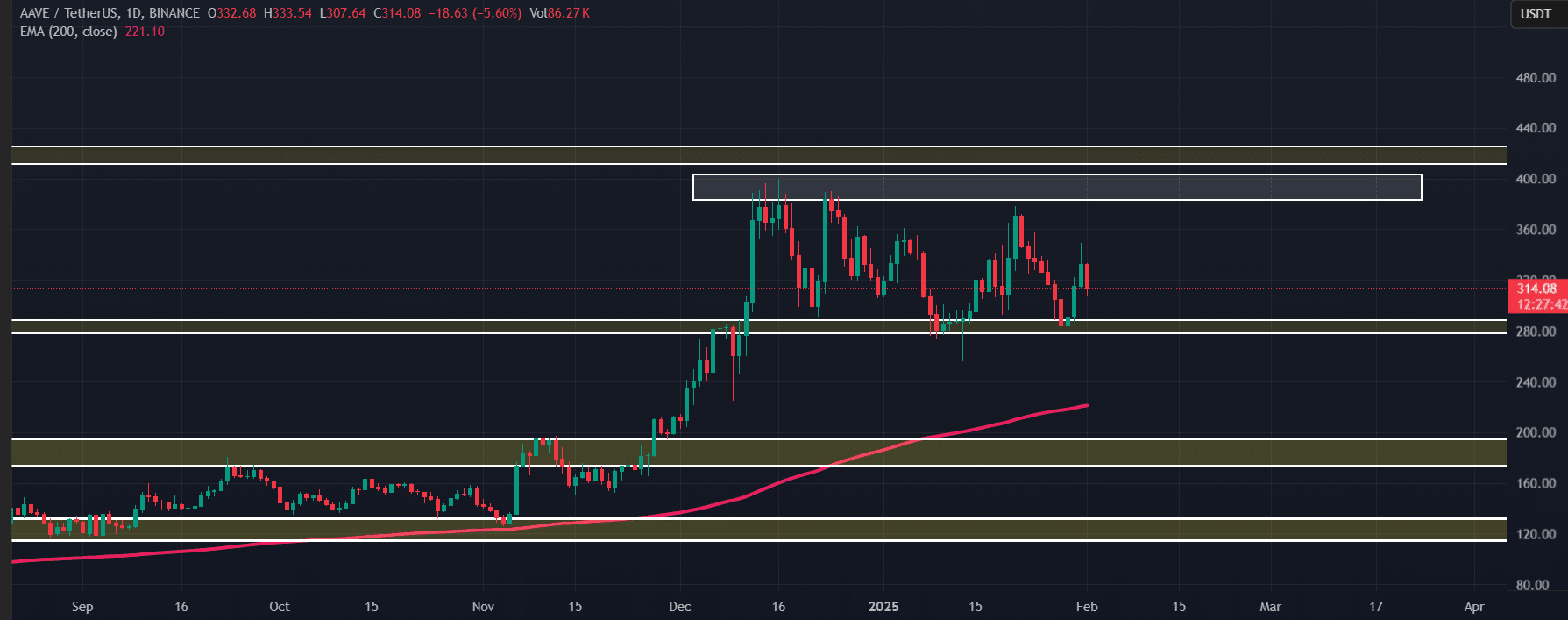

Recent analysis suggests that AAVE has been moving within a parallel channel pattern between $384 and $285 over the last three months. Given the current price action and market sentiment, AAVE may be heading towards the $285 support level.

Source: TradingView

Despite the bearish outlook, AAVE remains trading above the 200 Exponential Moving Average (EMA) on the daily chart, indicating a continued uptrend. Additionally, on-chain data points to the $343 and $365 levels as crucial resistance zones that could trigger a significant price movement if breached.