Ethereum Price Poised for $12,000 Breakout with Inverse Head and Shoulders Pattern

The Ethereum price is currently displaying promising signs of a potential breakout, with an analyst highlighting the formation of an inverse head and shoulders pattern on its long-term 6-month price chart. This bullish formation has sparked speculation that Ethereum could surge to $12,000 in the near future, setting a new all-time high for the second-largest cryptocurrency by market capitalization.

Ethereum Price Forecast and Chart Analysis

Crypto analyst Tony Severino recently shared a chart on X illustrating the formation of an inverse head and shoulders pattern on Ethereum’s price chart. This technical indicator is often seen as a signal for a possible trend reversal, moving from a downtrend to an uptrend. Despite a recent 8% decline in price, Severino remains optimistic about Ethereum’s potential, setting a bullish price target of $12,000 for the popular altcoin.

The pattern consists of a left shoulder formed in 2021, a head during a price crash at the end of 2022, and a right shoulder recently completed. Ethereum has tested the neckline, a crucial resistance level represented by a horizontal trendline. Breaking above $3,400 confirms the bullish trend reversal associated with this pattern.

Analysis of the chart indicates a potential rally of $10,000 to $12,000 based on the distance between the head and the neckline, which is approximately 265.84%. The upward-sloping channel of the inverse head and shoulders further supports this optimistic outlook, aligning with Severino’s price target projection.

Whales Accumulate Ethereum as Price Trends Upward

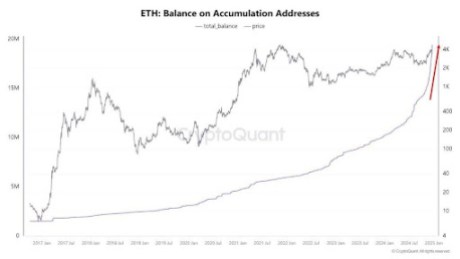

While Ethereum’s price currently hovers around $3,493 after a 2.3% increase in the past 24 hours, analyst ‘Mister Crypto’ revealed a notable trend in whale accumulation. Ethereum whales have been aggressively purchasing ETH tokens, steadily increasing their holdings since 2017. This surge in accumulation suggests that investors are positioning themselves for a potential bullish price surge.

Recent data indicates a significant spike in ETH balances on accumulation addresses, with most wallets associated with this increase showing minor outflows. This behavior suggests a long-term holding strategy by investors, further supporting the bullish sentiment surrounding Ethereum’s price potential.

With Ethereum’s price showing signs of a potential breakout and whales accumulating ETH tokens, the cryptocurrency market eagerly anticipates whether Ethereum will reach new heights and achieve the projected $12,000 target in the near future.