JuCoin Introduces USDT Fixed-Income Product with Tiered APY

Recently, JuCoin made waves in the trading platform industry by launching its first Tether (USDT) fixed-income product with a tiered APY structure. This Singapore-based platform now offers investors six different terms – 7, 15, 30, 45, 60, and 90 days – to choose from, catering to a wide range of preferences.

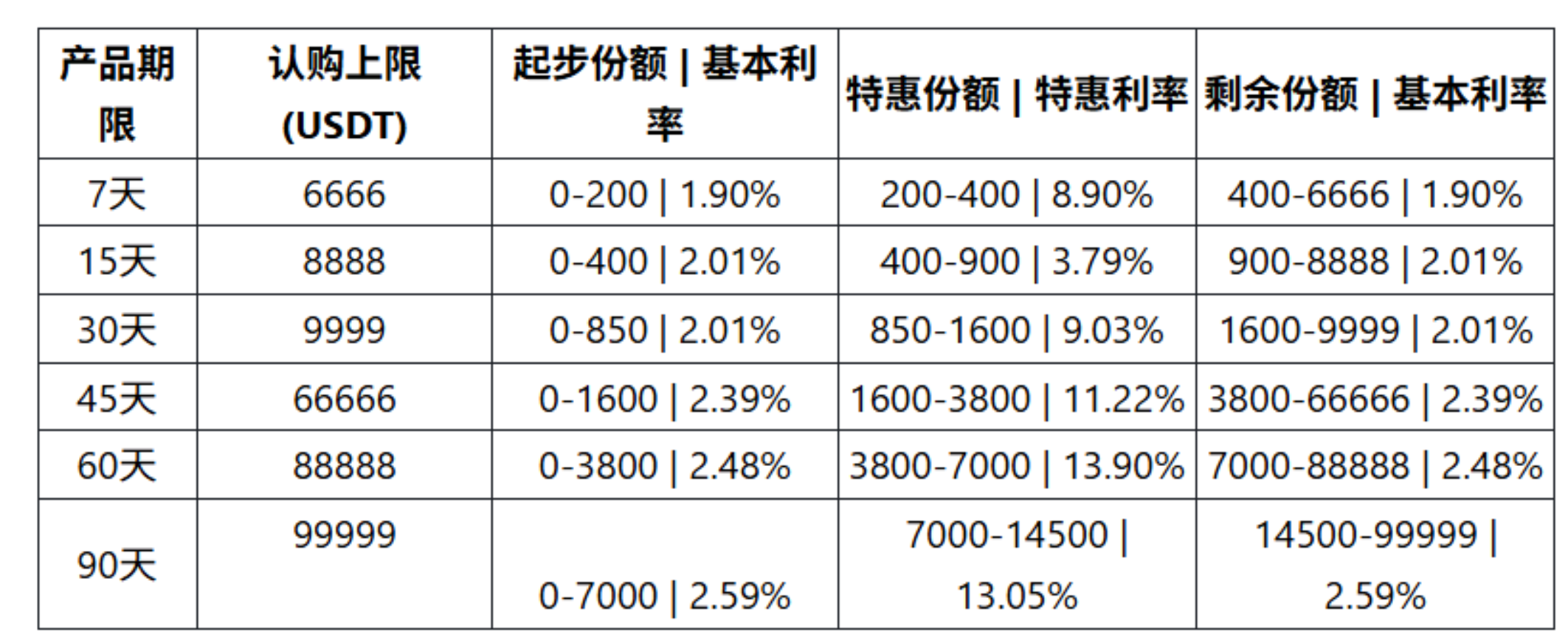

One of the standout features of JuCoin’s offering is its “ladder interest rate” model. This model allows investors to earn different yields based on the amount of their investment. Each product has a base quota with a standard interest rate, as well as a preferential tier that offers a higher rate. Any excess amount beyond this tier will revert back to the base rate. Earnings are calculated daily and automatically distributed upon the product’s maturity.

For instance, if an investor puts in 4,000 USDT into the 45-day product, the breakdown would be as follows: the first 1,600 USDT earns a base APY of 2.39%, the next 2,200 USDT qualifies for a higher APY of 11.22%, and the remaining 200 USDT goes back to the base rate. This results in a blended annualized return of around 7.25%.

Expanding Opportunities

JuCoin’s new offering adds to the growing list of trading platforms providing similar products. Bybit, for example, offers USDT-based options with tiered yields for different durations. Major exchanges like KuCoin, Binance, Kraken, and MEXC also offer USDT staking with a variety of APYs across fixed and flexible terms.

Fixed-term staking involves locking in USDT for a set period in exchange for a predetermined APY, with funds typically used for lending or yield-farming strategies. Flexible-term staking, on the other hand, allows users to deposit and withdraw USDT at any time, albeit with lower and fluctuating rates.