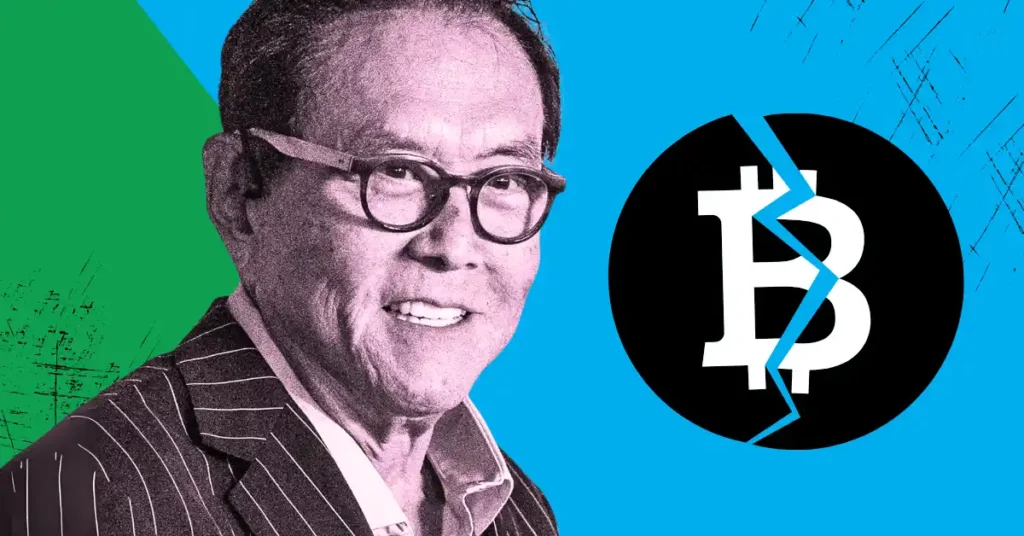

As the United States prepares for the potential impact of Donald Trump’s upcoming tariff policies, financial expert Robert Kiyosaki is raising concerns about Bitcoin’s price. Kiyosaki believes that a sharp crash could be on the horizon, but he sees it as an opportunity rather than a cause for panic.

In a recent tweet, Kiyosaki warned that as Trump’s new tariffs take effect, assets like gold, silver, and Bitcoin could experience a significant drop in price. However, Kiyosaki remains optimistic, stating, “Gold, silver, Bitcoin may crash. GOOD. Will buy more after prices crash.” He views market crashes as opportunities to invest in assets with long-term value, much like taking advantage of sales in a store.

Kiyosaki’s warning comes at a time when Bitcoin is trading within a narrow range of $101K to $106K. The potential increase in market volatility due to Trump’s tariff policies, set to go into effect on February 1, could impact global financial markets, including cryptocurrencies.

While Kiyosaki remains focused on the potential buying opportunities presented by market crashes, he also emphasizes a more significant concern – debt. He warns that the real problem lies in the escalating levels of debt in the economy, which he believes will only worsen over time. Addressing the debt crisis is crucial, as it poses a more profound and long-term threat to the financial stability of the economy.

Kiyosaki’s prediction aligns with the views of other analysts, such as Arthur Hayes, who anticipate a short-term decline in Bitcoin’s price, possibly dropping to $70,000 before embarking on a rally towards $250,000. On-chain data from Glassnode also indicates a significant price cluster for Bitcoin between $94,000 and $101,000, with $98,000 serving as a critical support level. The cryptocurrency’s ability to stay above this level will determine its bullish momentum, with a potential drop below opening the door to further declines.

As investors navigate the evolving landscape of the cryptocurrency market, staying informed and prepared for potential price fluctuations is key. Keeping abreast of breaking news, expert analysis, and real-time updates on Bitcoin and other digital assets can help investors make informed decisions and seize opportunities as they arise.