The recent events surrounding the use of Lobby Finance to buy votes in Arbitrum DAO elections have sent shockwaves through the decentralized governance community. This incident has exposed critical vulnerabilities in token-weighted governance systems, raising concerns about the integrity of DAO structures and their foundational principles.

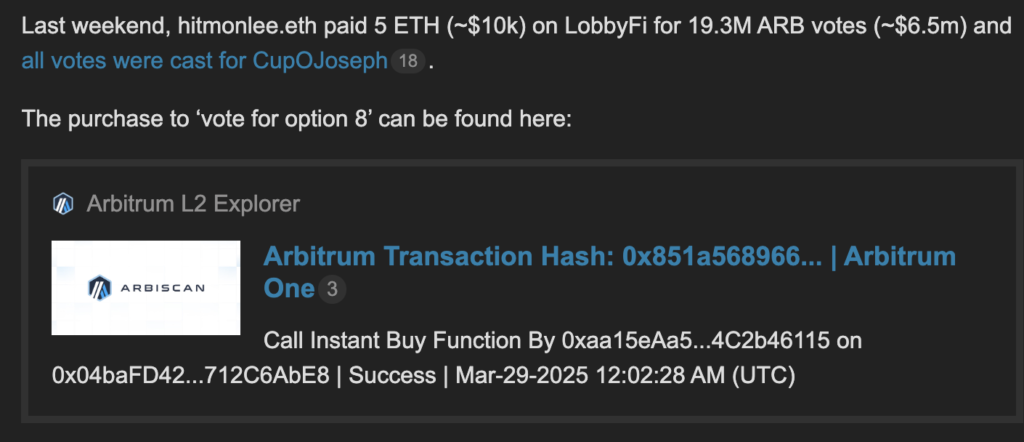

The controversy erupted when hitmonlee.eth paid a substantial sum of 5 ETH (equivalent to roughly $10,000) to acquire 19.3 million ARB tokens’ worth of voting power through Lobby Finance. This platform allows token holders to delegate their votes in exchange for yield, creating a marketplace where voting power can be bought and sold.

All of the purchased votes were directed towards electing CupOJoseph to Arbitrum’s newly formed Oversight and Transparency (OAT) Committee. This move highlighted the potential for external influence to sway major decisions within DAOs, undermining the principles of decentralization and community governance.

Lobby Finance had been operating within Arbitrum’s governance ecosystem for some time, facilitating the auctioning and selling of idle voting power. However, the recent transaction brought to light the significant impact that vote-buying can have on the democratic process within DAOs. For a flat rate of 5 ETH, all voting power in the OAT election could be instantly bought, resulting in a winner-takes-all scenario.

The financial incentives associated with winning the committee seat added another layer of complexity to the situation, with Joseph potentially earning a substantial reward for securing the position. Despite this, CupOJoseph himself expressed concerns about the ability to extract significant value from the DAO through such transactions, prompting a broader discussion within the community about the risks of vote-buying.

In response to the controversy, the Arbitrum Foundation swiftly launched an open forum discussion to address the growing unease surrounding vote manipulation in DAO elections. The Foundation acknowledged the precedent-setting nature of the situation and emphasized the need for community-led solutions to safeguard the integrity of governance processes.

Proposed mechanisms to defend the DAO from vote manipulation include disqualifying purchased votes from the final tally and implementing safeguards through trusted multisigs. However, each solution presents trade-offs between decentralization, security, and fairness, underscoring the complexity of addressing governance manipulation in decentralized systems.

As the Arbitrum DAO navigates this challenging dilemma, the community is called upon to lead the discussion on how to uphold the principles of decentralized governance while mitigating the risks of external influence. The controversy surrounding Lobby Finance serves as a stark reminder of the importance of vigilance and transparency in safeguarding the integrity of DAO structures and ensuring the democratic participation of token holders in governance decisions.