MANTRA Launches RWAccelerator Program to Support RWA Startups

MANTRA has recently unveiled RWAccelerator, a startup program in collaboration with Google Cloud, aimed at providing funding, mentorship, and AI support to projects focusing on tokenizing real-world assets.

The RWAccelerator program, backed by Google Cloud, is specifically tailored for startups operating in real estate, finance, and alternative assets sectors that are exploring the tokenization of real-world assets. The program offers three distinct tracks for participants to choose from: infrastructure, tokenization, and DeFi. Selected startups will have the opportunity to access a range of Google Cloud resources, including cloud credits, technical support, and workshops.

The first intake for applications is currently open until March 20, with successful applicants set to be notified by April 1. The second intake is scheduled to open on March 20.

“This initiative presents a significant opportunity for startups to leverage cutting-edge technology and gain valuable mentorship and resources,” stated John Patrick Mullin, CEO of MANTRA. “With the support of Google Cloud, the RWAccelerator program will empower startups to achieve new milestones and make substantial contributions to the broader Web3 community.”

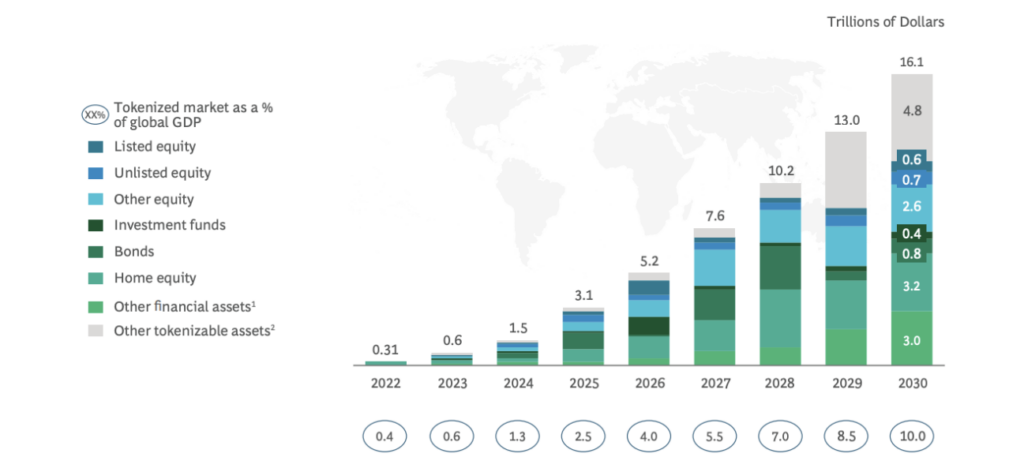

The launch of RWAccelerator comes at a pivotal moment for the tokenization of real-world assets. The World Economic Forum estimates that by 2027, approximately 10% of global GDP, equivalent to around $10 trillion, could be stored on blockchain networks. Additionally, the Boston Consulting Group forecasts that tokenized assets could represent a market worth $16 trillion by 2030.

RWAs and MANTRA

Real-world assets encompass physical or intangible assets such as real estate, commodities, bonds, and art. Traditionally managed within conventional financial systems, these assets face limitations in terms of access and liquidity. Through tokenization, these assets can be digitally represented on a blockchain, transforming their ownership, trading, and management processes.

MANTRA operates as a Layer 1 blockchain, focusing on addressing the core challenges associated with RWA tokenization by emphasizing security, compliance, and scalability. The platform facilitates seamless asset transfers across various blockchains using the Inter Blockchain Communication Protocol, thereby reducing liquidity fragmentation.

To ensure trust and regulatory compliance, MANTRA integrates compliance tools like KYC verification, AML protocols, and transaction monitoring. Its modular architecture, developed with the Cosmos SDK, offers a flexible and scalable foundation for managing complex RWAs. The network functions on a Proof-of-Stake validator system with Byzantine-Fault-Tolerant consensus, ensuring swift, secure, and efficient transactions.

MANTRA’s governance structure is decentralized, enabling token holders (OM holders) to actively engage in key decisions concerning network updates and enhancements.

As of the latest data, MANTRA’s token OM is valued at $7.37, exhibiting a decrease of $1.82 in the past 24 hours. However, the token has witnessed a 27% and 106% increase on the weekly and monthly timeframes respectively, as per Coinmarketcap.