MARA Holdings, Inc. Achieves Record-Breaking Bitcoin Production in May 2025

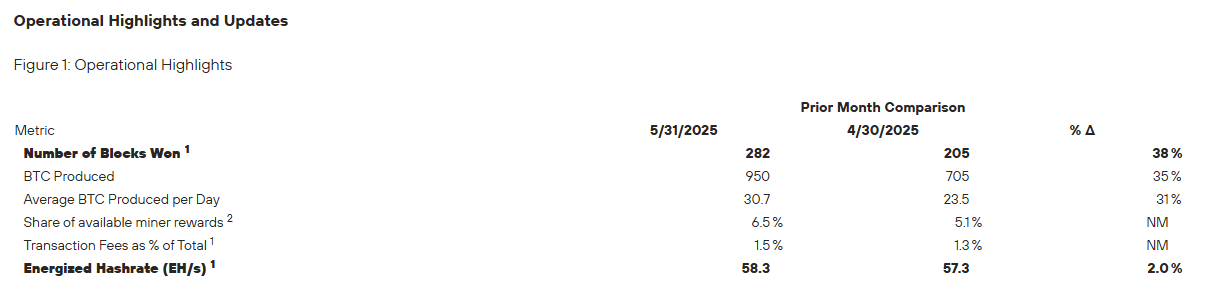

On the latest report from MARA Holdings, Inc. (NASDAQ: MARA), it was revealed that the company had an exceptional month of bitcoin production in May 2025. With a total of 950 BTC mined, valued at over $100 million, MARA achieved a 35% increase from the previous month, marking it as the highest monthly output since the April 2024 halving event. Interestingly, MARA did not sell any bitcoin during the month of May, showcasing their commitment to holding onto their assets.

Chairman and CEO of MARA, Fred Thiel, expressed his enthusiasm about the record-breaking month, stating, “May was a remarkable month for MARA with 282 blocks won, a 38% increase from April and a new monthly high. Our total bitcoin holdings surpassed 49,000 BTC during May, and the 950 bitcoin produced were the most since the halving event in April 2024.”

The company mined a total of 282 blocks in May, showing a significant 38% increase from the previous month. MARA now holds 49,179 BTC, with a current value of approximately $5.23 billion.

Thiel emphasized the importance of MARA’s self-owned and operated mining pool, MARA Pool, as a key differentiator for the company. He mentioned, “Our fully integrated tech stack and the operational control offered by MARA Pool have contributed to our industry-leading block production. With no fees to external operators and the retention of the full value of block rewards, our mining operations have seen significant success.”

Furthermore, MARA’s operational efficiency saw improvements, with energized hashrate increasing by 2% from 57.3 EH/s to 58.3 EH/s. The average daily bitcoin production for MARA reached 30.7 BTC, a 31% increase from the previous month.

Looking ahead, Thiel highlighted MARA’s focus on becoming a vertically integrated digital energy and infrastructure company. This strategic approach aims to enhance operational control, cost-efficiency, and resilience to economic fluctuations.

Earlier this month, MARA released its first-quarter earnings for 2025, reporting $213.9 million in revenue, a 30% increase compared to the same period last year. The company’s bitcoin holdings also saw significant growth, with a 174% year-over-year increase from 17,320 BTC to 47,531 BTC by March 31. Operational performance metrics, such as energized hashrate and cost per petahash per day, demonstrated strong improvements, showcasing MARA’s commitment to operational excellence.