Metaplanet Acquires Additional 1,088 Bitcoin, Bringing Total Holdings to 8,888 BTC

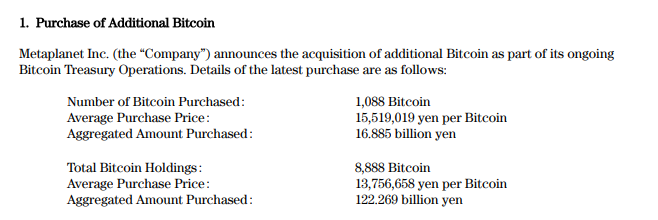

Metaplanet, a prominent Bitcoin treasury firm based in Japan, recently made a significant move by purchasing an additional 1,088 Bitcoin for approximately ¥16.89 billion. This acquisition was made at an average price of ¥15,519,019 per BTC, increasing the company’s total Bitcoin holdings to 8,888 BTC. The cumulative purchase cost of all Bitcoins owned by Metaplanet now stands at ¥122.27 billion, with an average price of ¥13,756,658 per BTC.

Metaplanet’s Strong BTC Yield Performance

Metaplanet has been consistently delivering impressive results under its BTC Yield metric, a key performance indicator that measures Bitcoin accumulation per share. As of June 2, 2025, the company’s BTC Yield for the quarter stands at 66.3%, following exceptional yields of 95.6%, 309.8%, and 41.7% in the previous three quarters. In Q2 2025 alone, Metaplanet gained 2,684 BTC, amounting to a ¥40.54 billion profit based on a reference Bitcoin price of ¥15.10 million.

Financial Growth and Strategic Investments

Metaplanet’s capital markets activity has been closely aligned with its Bitcoin accumulation strategy. Through a series of zero-coupon, non-interest-bearing bond issuances and stock acquisition rights, the company raised over ¥35 billion and USD 121 million since January 28, 2025. These funds were utilized for Bitcoin purchases and bond redemptions, further strengthening Metaplanet’s financial position.

In Q1 FY2025, Metaplanet reported remarkable financial results, with revenue increasing by 8% quarter-over-quarter to ¥877 million and operating profit rising by 11% to ¥593 million. The company’s net income saw a substantial surge to ¥5.0 billion, supported by unrealized gains of ¥13.5 billion from its Bitcoin holdings, enhancing its overall balance sheet.

Metaplanet’s Resilience Amid Market Volatility

Despite a brief dip in Bitcoin prices towards the end of March, resulting in a ¥7.4 billion valuation loss, Metaplanet quickly recovered as Bitcoin surged to new record levels. The firm’s strong correlation with Bitcoin’s performance has positioned it as a popular investment choice for those seeking exposure to Bitcoin on the Tokyo Stock Exchange.

Additionally, Strategy, another major player in the Bitcoin treasury space, recently expanded its Bitcoin holdings by acquiring 705 Bitcoin for approximately $75 million. This move solidified Strategy’s position as the largest corporate holder of Bitcoin, as more public companies embrace Bitcoin treasury strategies.

According to their SEC filing on June 2, Strategy purchased Bitcoin at an average price of $106,495 each between May 26 and June 1, reaching a total of 580,955 BTC. The acquisition was funded through the sale of preferred shares via an at-the-market (ATM) equity offering.