New Data Suggests Bitcoin Could Be Nearing Early Bear Market

Recent data from the market intelligence firm Glassnode indicates that Bitcoin (BTC) may be on the verge of entering an early bear market phase. The analysis suggests that certain indicators are flashing warning signs that have historically preceded bearish trends in the crypto king’s price movements.

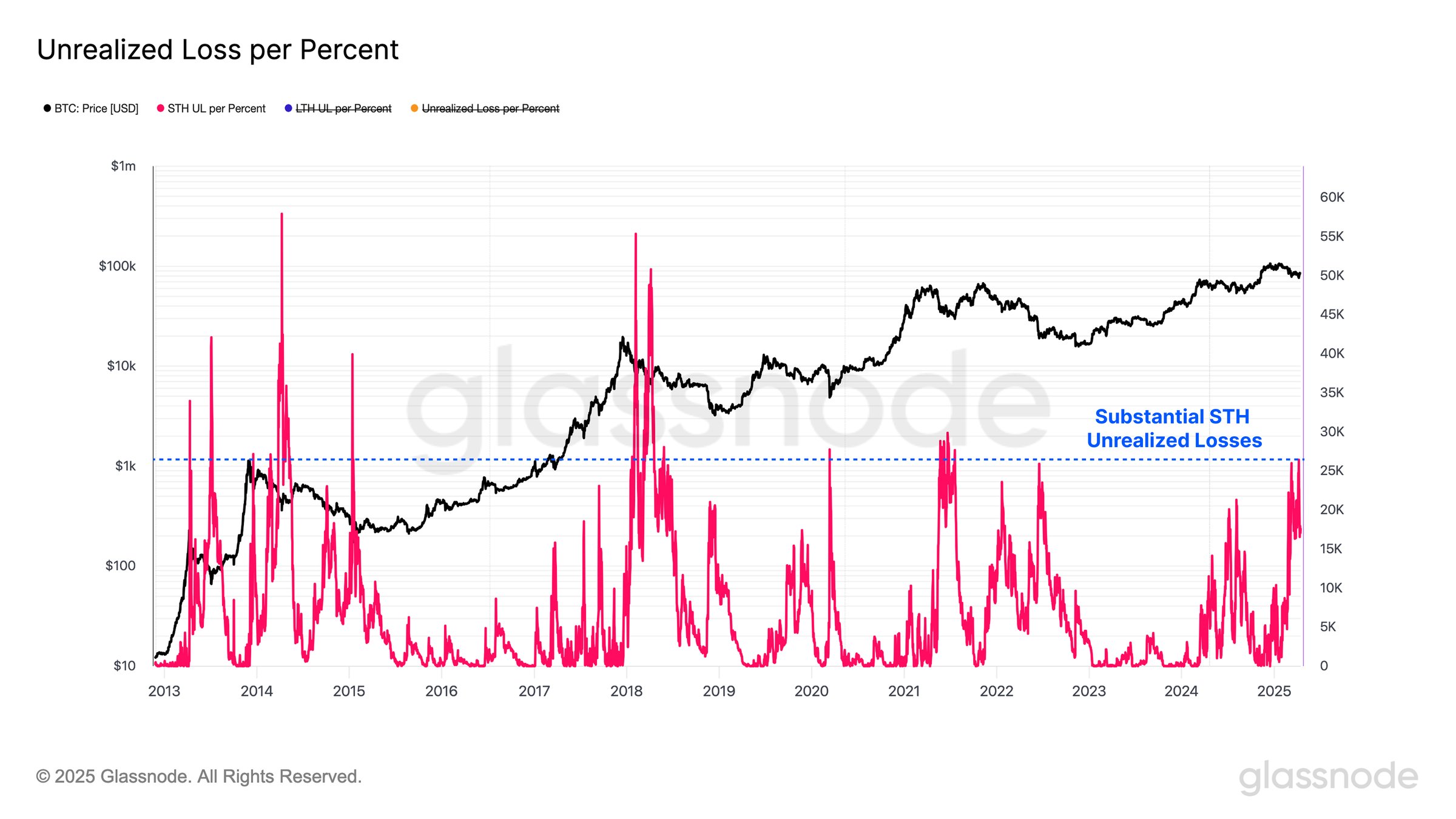

Short-Term Holders Facing Unrealized Losses

Glassnode’s research reveals that short-term holders of Bitcoin are currently holding onto unrealized losses compared to the cryptocurrency’s current market price. This scenario is reminiscent of conditions seen in the early stages of bear markets during previous Bitcoin cycles.

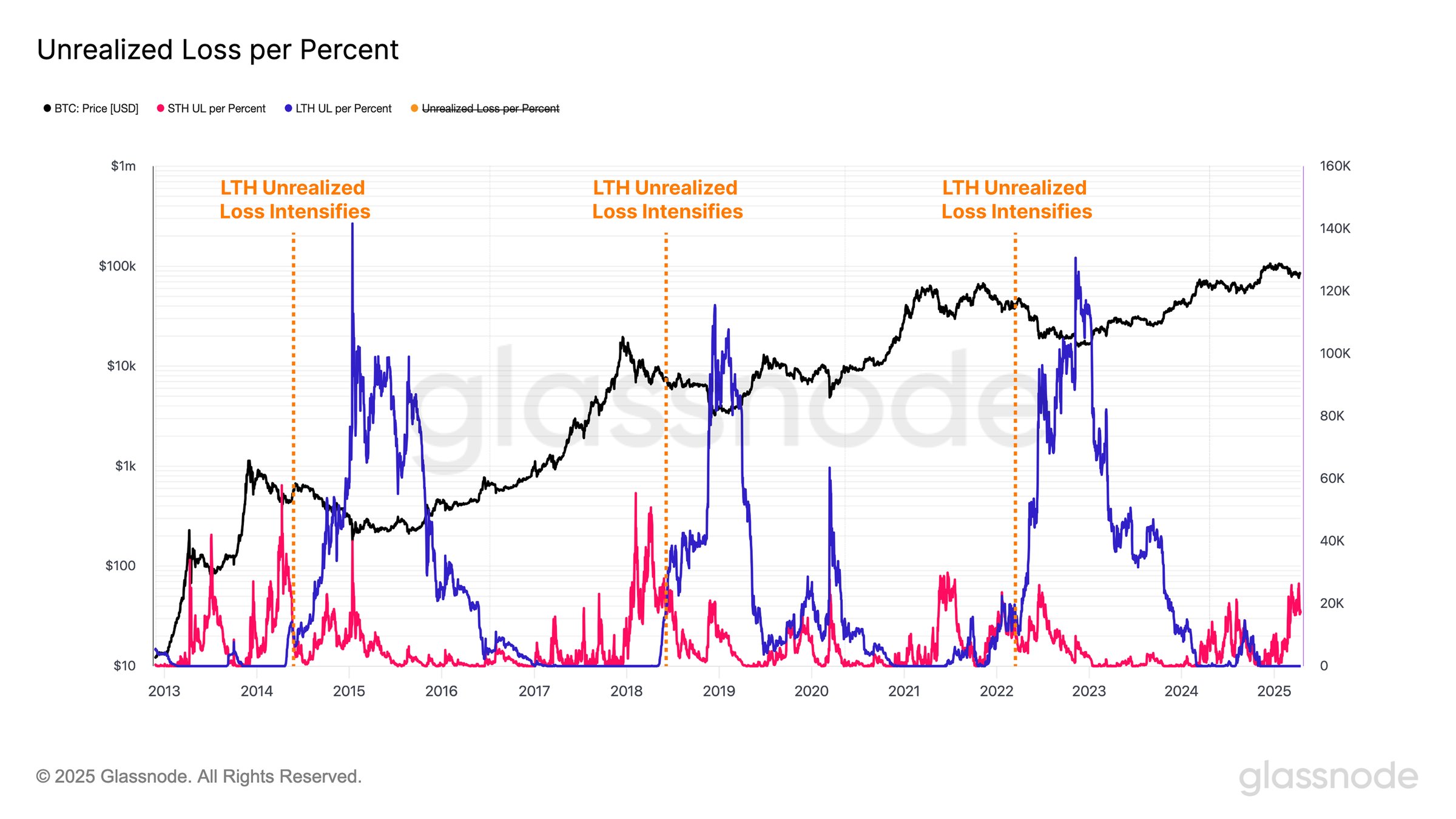

Furthermore, long-term holders of Bitcoin are still in a profitable position. However, market dynamics could lead to a decrease in their profits, signaling another indication of an impending bearish phase.

Key Metrics Point to Market Direction

Glassnode highlights a metric that measures the directional flow of value within the Bitcoin network. This metric suggests that Bitcoin is at a critical juncture in determining its market direction, with the potential for a shift from a bullish to a bearish regime.

As of the latest data, Bitcoin is trading at $84,557, representing a slight decrease over the past 24 hours.

Stay Informed with The Daily Hodl

For more updates on Bitcoin and the cryptocurrency market, follow The Daily Hodl on X, Facebook, and Telegram. Subscribe to receive email alerts and stay on top of price action trends.

Don’t Miss Out on The Daily Hodl Mix

Explore a mix of content from The Daily Hodl to stay informed about the latest developments in the cryptocurrency space.

Generated Image: Midjourney