A Prominent Analyst Believes Bitcoin Could Turn Bullish Soon

A well-known crypto analyst has suggested that Bitcoin (BTC) might experience a sudden bullish trend based on a crucial indicator.

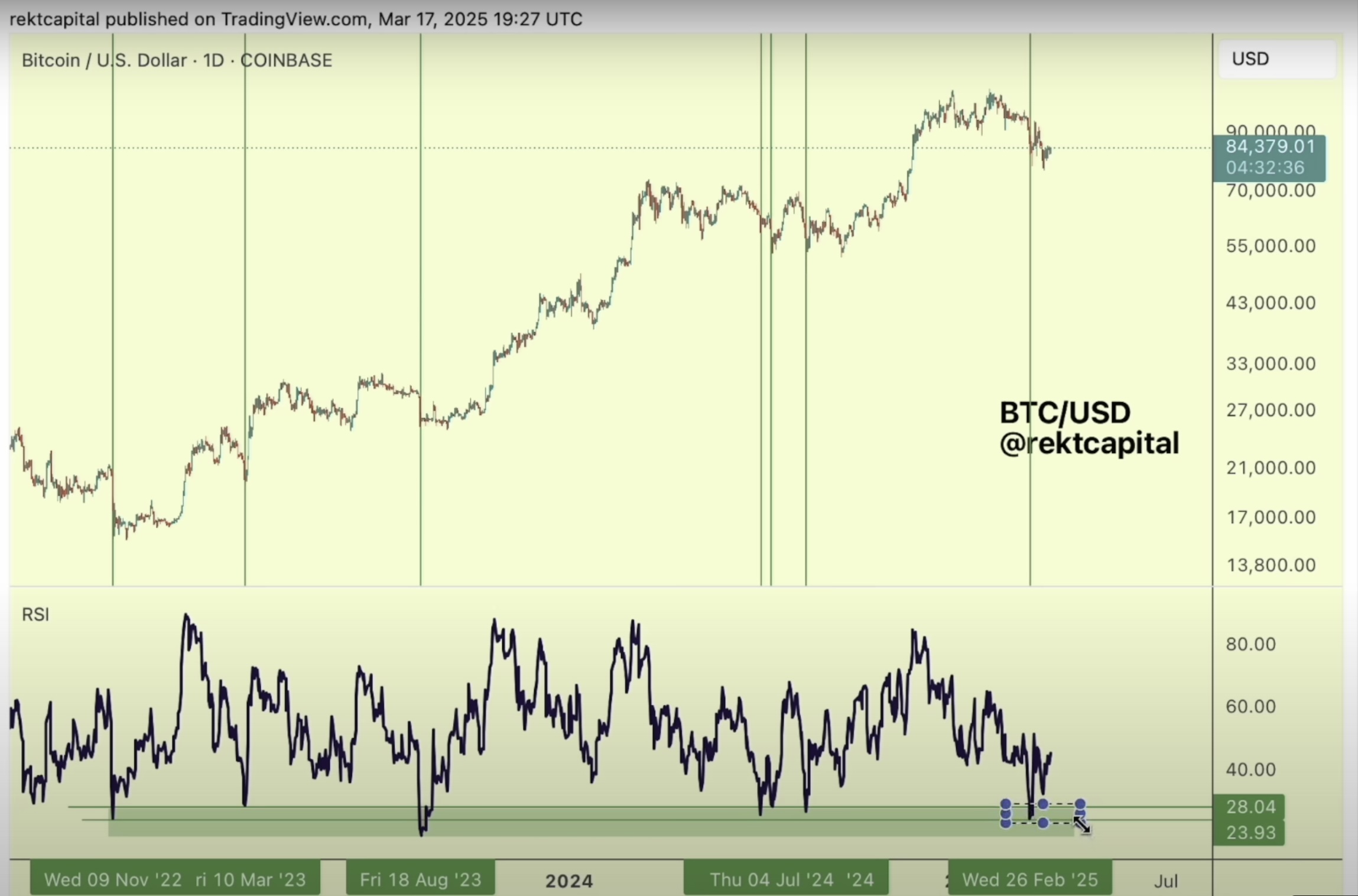

Rekt Capital, a respected trader in the crypto community, shared with his large following on X that the Relative Strength Index (RSI) could be on the verge of breaking out of a downtrend. The RSI is a momentum indicator used to determine overbought or oversold conditions, and a breakout from this downtrend could signal a bullish trend for Bitcoin.

During a recent strategy session, Rekt Capital highlighted that the RSI had bounced off the oversold range in the 20s, historically leading to a price reversal for Bitcoin. He explained,

“When we see the RSI drop below 30, sellers tend to become overly enthusiastic, leading to overselling. As sellers exhaust themselves, buyers have an easier time stepping in and driving prices up. This pattern has repeated several times in this cycle, often signaling a price reversal towards the upside.”

Additionally, Rekt Capital noted that Bitcoin’s retracement from its all-time high is not unusual when compared to past trends. He stated,

“The current pullback of around 29% is significant but not unprecedented. Previous cycles have seen deeper retracements, such as a 32% drop post-halving and even larger corrections in both the 2021 and 2017 cycles.”

At the time of writing, Bitcoin is trading at $83,112, maintaining a relatively flat performance for the day.

Stay updated with the latest news by following us on X, Facebook, and Telegram.

Don’t miss out – subscribe to receive email alerts directly to your inbox and keep track of price movements. Explore The Daily Hodl Mix for more insights.

Image Source: Midjourney