Restaking in DeFi is revolutionizing the way people interact with cryptocurrencies. It allows users to maximize their staked ETH by securing multiple decentralized services on Ethereum. This concept is akin to rehypothecation in traditional finance, where collateral is reused to unlock more value. Restaking brings this idea into the decentralized, programmable world of crypto.

EigenLayer is at the forefront of the restaking movement, with over $10 billion in total value locked (TVL). This protocol enables stakers to support external services called Actively Validated Services (AVSs) using their already staked ETH. Platforms like Renzo and Ether.Fi offer liquid restaking tokens (LRTs) that can be used across various DeFi protocols.

Restaking involves staking your ETH on Ethereum and then opting into a restaking protocol to secure other decentralized systems. It’s like subletting rooms in a house without buying another property. With liquid restaking, you receive LRTs in return for restaking, which can be used in other DeFi applications.

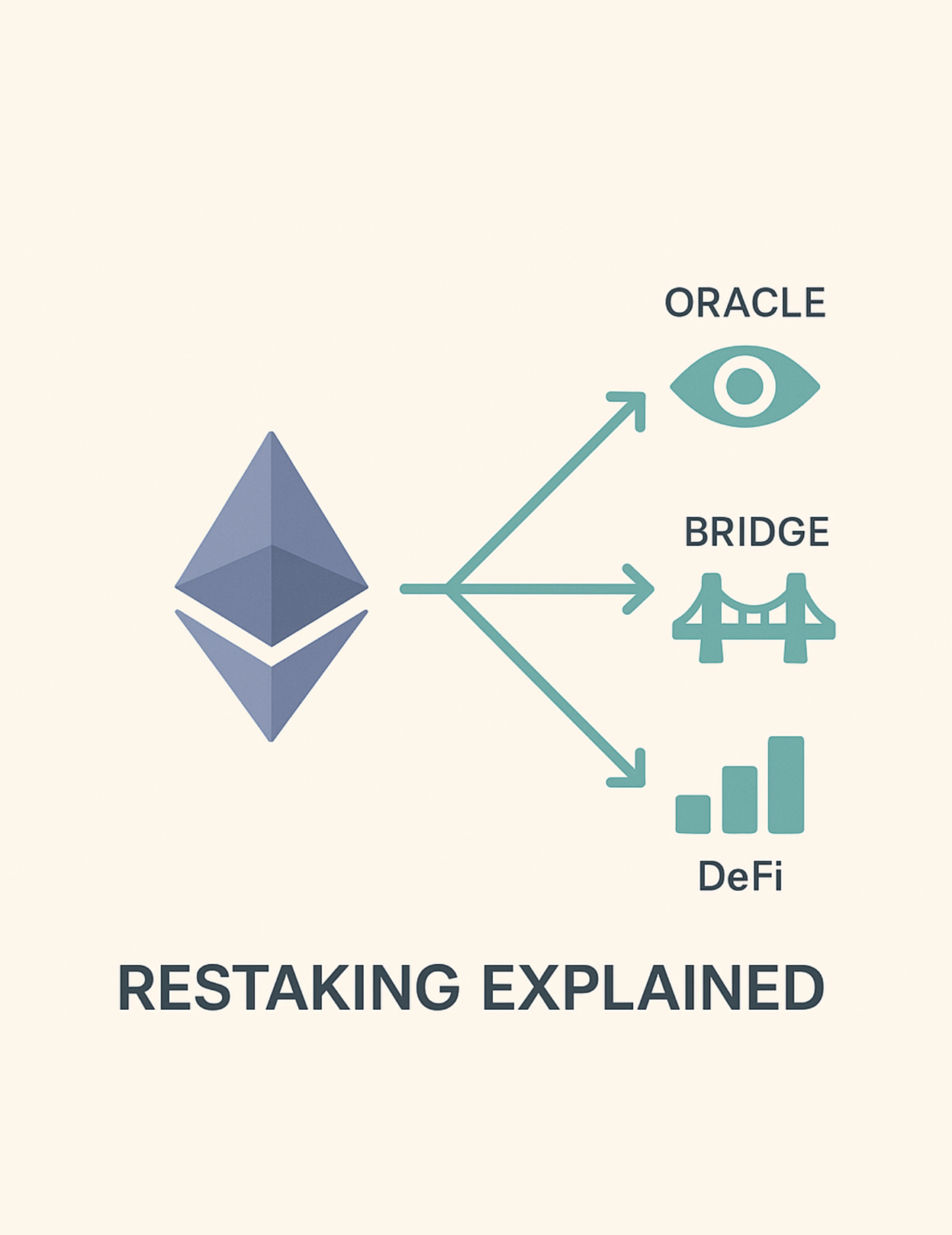

Restaking expands the support beyond just Ethereum to other protocols like oracle networks, cross-chain bridges, and data availability layers. It offers additional rewards from AVSs while maintaining the security of the original staked ETH.

There are two main types of restaking: native and liquid. Native restaking is for advanced users who run their own Ethereum validator nodes, while liquid restaking is for everyday DeFi users who want passive yield without managing complex infrastructure.

The benefits of restaking include capital efficiency, extra yield from AVSs, shared security for new protocols, and sustainable ecosystem growth. However, there are also risks involved, such as slashing from AVS failures, smart contract risks, regulatory uncertainty, and systemic risks.

To get started with restaking, users need a self-custody wallet, staked ETH or LSTs, and access to a restaking platform like EigenLayer for native restaking or Renzo and Ether.Fi for liquid restaking. It’s essential to start small, do thorough research, and stay informed about the platforms and AVSs being supported.

Taxes on restaked tokens can be complex, as rewards earned from restaking are usually taxed as ordinary income. It’s crucial to consult a crypto tax professional and use tools to track and categorize rewards accurately.

In conclusion, restaking in DeFi is a powerful tool for maximizing the potential of staked ETH and supporting the growth of decentralized infrastructure. By understanding the benefits, risks, and how to get started, users can make informed decisions about incorporating restaking into their crypto strategy.