The tokenization of real-world assets (RWAs) is projected to see a significant surge in the coming years, with experts estimating the market to reach a staggering $18.9 trillion by 2033. This forecast, however, is believed to be conservative by many industry insiders, especially considering the rapid adoption of stablecoins that could potentially fuel an even larger expansion of the market.

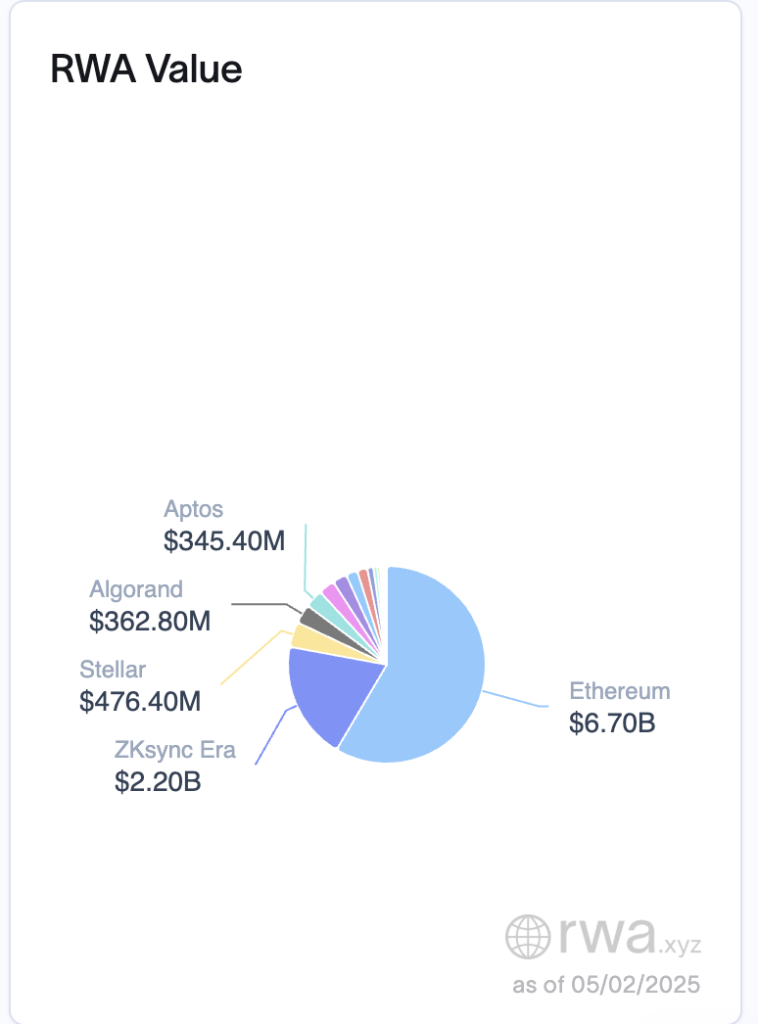

As the market for tokenized RWAs continues to grow, blockchain adoption metrics are also on the rise. According to industry data, Ethereum is currently leading the pack, driving 60% of the total RWA tokenization value. However, Ethereum is not the only Layer-1 (L1) blockchain making waves in this space.

Stellar, the second-largest Layer-1 blockchain for RWA value after Ethereum, has been gaining traction in the tokenization of real-world assets. Denelle Dixon, the executive director of Stellar Development Foundation, revealed that the network has seen around $470 million in tokenized treasuries, commodities, and yield-bearing stablecoins.

One notable example of Stellar’s success in the RWA space is its partnership with Franklin Templeton, one of the world’s largest financial institutions. Franklin Templeton launched a tokenized money market fund on Stellar, known as the OnChain U.S. Government Money Market Fund (FOBXX), which has grown to become the third-largest tokenized money market fund. The majority of the fund’s $701.7 million in total asset value is held on the Stellar network.

Stellar’s focus on tokenizing securities has enabled institutions to significantly reduce transaction costs, making it a cost-effective solution for asset issuance and trading. The network aims to power $3 billion in RWA value on-chain within the current year through new partnerships and collaborations with firms like Societe Generale-Forge and Ondo.

Avalanche, another prominent L1 blockchain, is also making strides in the tokenized RWA market. The network’s high throughput, sub-second finality, and low transaction costs make it an ideal platform for real-world asset tokenization. Avalanche has partnered with asset management firm WisdomTree to offer 13 tokenized funds across various blockchains, including Avalanche.

In addition, Avalanche has seen success with the launch of IntainMARKETS, an on-chain marketplace for asset-backed securities that has facilitated over $6 billion in tokenized loans. The network aims to expand the diversity and scale of tokenized RWAs, offering a wide range of assets from stablecoins to stocks, bonds, and private credit.

Injective, another L1 network, is focused on creating compliant RWA tokenization solutions through a native token factory and permissions module. The network allows issuers to create secondary markets for their assets, democratizing access to products previously only available to a select few. Injective’s goal is not just RWA issuance but activating real utility in DeFi, including secondary trading, margin, and lending use cases.

Despite the rapid growth of tokenized RWAs, challenges remain in the industry. Creating consistent demand and secondary market liquidity for tokenized assets has been a hurdle, as many financial institutions still operate on legacy systems. Regulatory frameworks across jurisdictions also pose challenges, but industry experts are optimistic about the future of tokenized RWAs.

Overall, 2025 is expected to be a milestone year for the tokenization of real-world assets, with institutional interest turning into action and regulatory clarity slowly improving. As infrastructure matures and tokenization becomes a core part of asset issuance and trading, exponential growth in on-chain volumes is anticipated in the near future.