Tracking the Rise of Layer 2 Solutions in the Crypto Market

This is a segment from the Empire newsletter. To read full editions, subscribe.

Wondering how to assess the performance of the crypto market beyond just looking at price fluctuations? According to Kaiko, the answer lies in Layer 2 solutions.

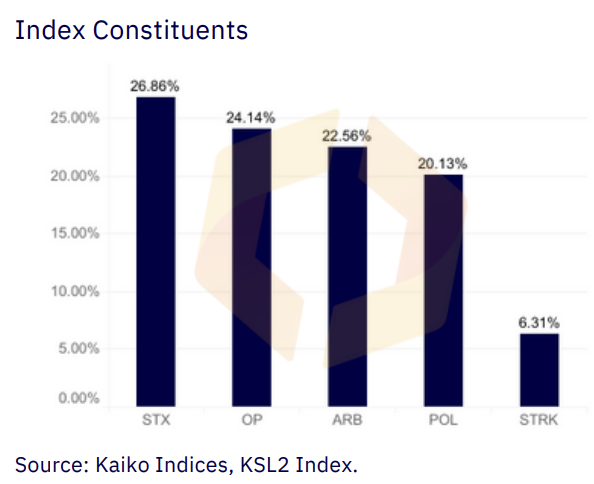

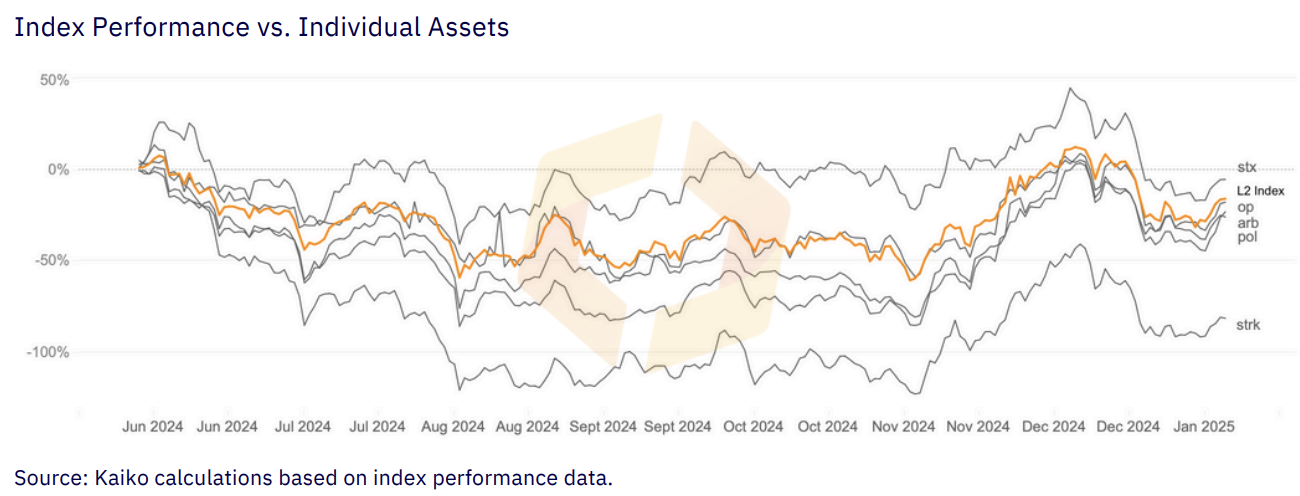

Since the recent election, Kaiko’s L2 index has been on the rise, reflecting the overall optimism in the crypto space. The index monitors five key Layer 2 solutions across Bitcoin, Ethereum, and Polygon.

The index includes Stacks, Optimism, Arbitrum, Polygon, and Starknet, showcasing the growing prominence of Layer 2 technologies in the market.

While Layer 2 solutions faced some challenges in the past year, they are now experiencing a resurgence in demand. A recent Galaxy report even projects that $47 billion worth of Bitcoin could be transferred to Bitcoin’s Layer 2 solutions by 2030, indicating a significant potential for growth.

With Bitcoin no longer dominating the market narrative as it once did, there is room for other assets, especially Layer 2 solutions, to shine. Kaiko analyst Adam McCarthy predicts that a sector rotation towards high-beta tokens like Layer 2 assets is likely to occur as investors seek new opportunities beyond Bitcoin.

Regulatory changes also play a significant role in shaping the future of Layer 2 solutions. Despite past regulatory challenges, such as the SEC labeling MATIC as a security, the landscape for Layer 2 technologies looks promising.

McCarthy notes that while investing in Bitcoin remains popular, the potential for growth lies in alternative assets like Layer 2 solutions. As regulatory dynamics evolve and investors diversify their portfolios, Layer 2 solutions are poised for substantial growth in 2025.

Overall, the outlook for Layer 2 solutions in the crypto market appears bright, with potential for significant growth and innovation on the horizon.