North Korean Hackers and On-Chain Project Failures Cause Mass Exodus of User Assets in DeFi

The decentralized finance (DeFi) space has been rocked by a series of high-profile hacks and project failures, leading to a significant outflow of user assets amounting to tens of millions of dollars.

DeFi Chains Struggle as User Deposits Plummet

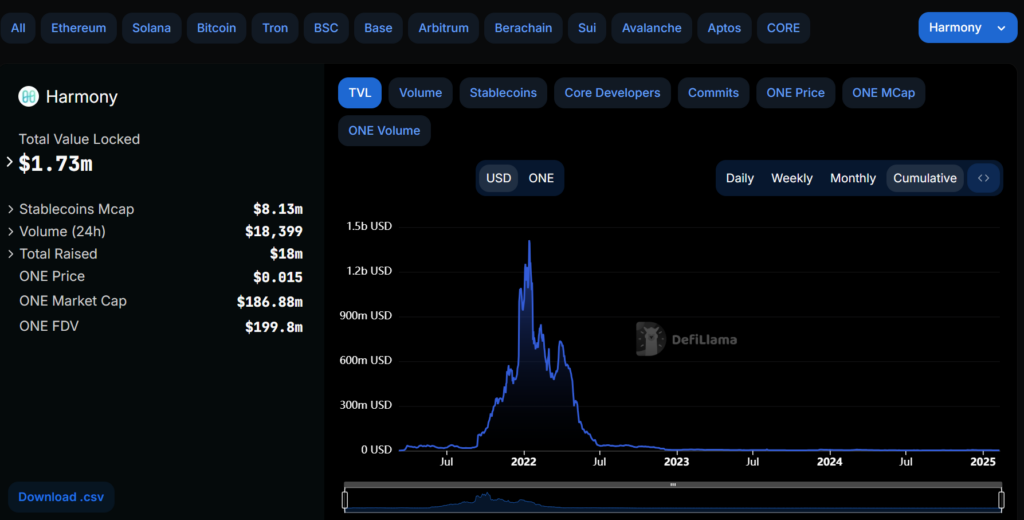

Data from DefiLlama reveals that several DeFi chains have seen a drastic decline in total user deposits, with some losing as much as 90% of their value over the past few years, particularly since the last crypto bull market. On-chain analyst 0xThoor highlighted Harmony, an Ethereum Virtual Machine-compatible blockchain, as one of the hardest-hit projects in terms of DeFi total value locked.

Harmony, which launched its layer-1 mainnet in 2019, experienced a surge in total value locked (TVL) to over $1.4 billion by January 2022, reaching an all-time high. However, the project suffered a major setback in June when North Korean hacker group Lazarus stole $100 million from Harmony’s Horizon bridge in one of the largest DeFi hacks on record. As a result, Harmony’s TVL plummeted by 99% to $1.7 million.

Other DeFi projects such as Aurora, Moonrise, Canto, and Evmos have also seen their TVL drop by over 90%, while even popular Ethereum scaling solution Polygon has lost 92% of its TVL, falling from $9.9 billion in 2021 to $700 million in early 2025. Analysts predict that more projects will face similar challenges in the coming years as the DeFi landscape evolves.

Future Outlook for DeFi

Despite the setbacks faced by many DeFi protocols, the overall DeFi TVL currently stands at over $106 billion, showing resilience in the face of adversity. Projects like Base, supported by Coinbase, and advancements in Bitcoin DeFi interoperability are expected to drive the on-chain ecosystem to new heights as adoption continues to grow.