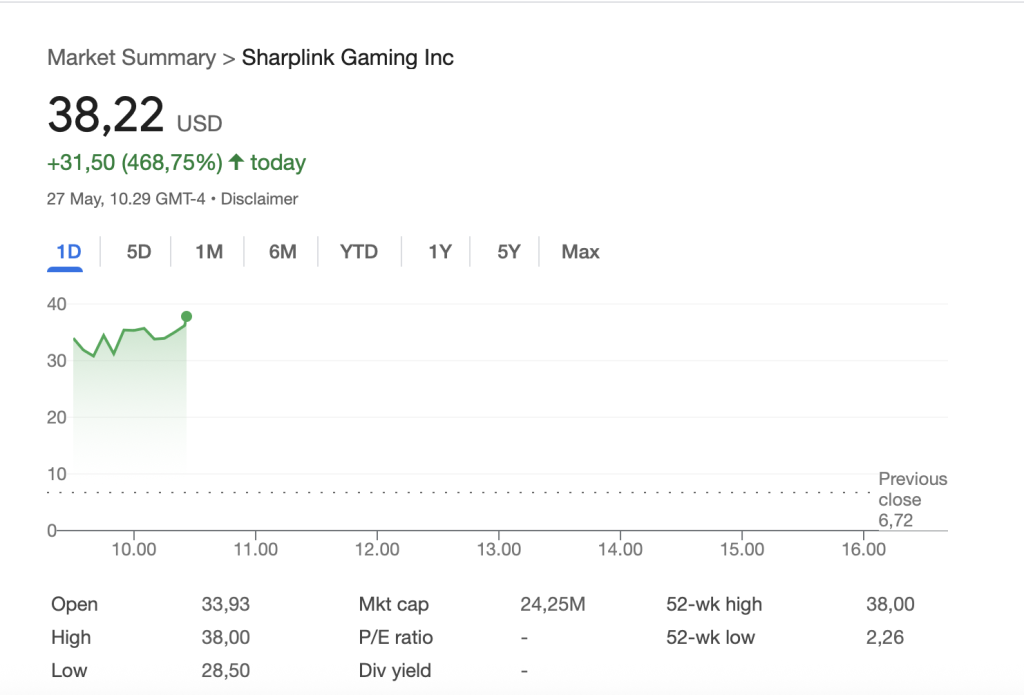

SharpLink Gaming (Nasdaq: SBET) has made headlines with a massive $425 million private investment in a public equity deal, led by blockchain leader Consensys Software Inc. This move signifies a significant milestone for the sports betting and iGaming company, causing its shares to surge by an impressive 468% following the announcement on May 27.

In a groundbreaking decision, SharpLink Gaming has revealed its plans to adopt Ethereum as its primary treasury reserve asset, marking a pivotal moment in the integration of cryptocurrency into the balance sheets of public companies. The Private Investment in Public Equity (PIPE) agreement includes the purchase of over 69 million shares of common stock at $6.15 per share (or $6.72 for certain management participants) and is set to close around May 29, 2025, pending customary closing conditions.

The capital raise also saw participation from prominent crypto venture firms and ecosystem leaders such as ParaFi Capital, Electric Capital, Pantera Capital, Galaxy Digital, and others. As part of the deal, Joseph Lubin, Founder and CEO of Consensys and Co-Founder of Ethereum, will join SharpLink’s Board of Directors as Chairman upon closing.

The collaboration between SharpLink Gaming and Consensys reflects the growing trend of integrating Ethereum into corporate finance strategies, leveraging Consensys’ expertise in decentralized finance, identity, and infrastructure. Rob Phythian, Founder and CEO of SharpLink, expressed his excitement about the partnership, stating, “This is a significant milestone in SharpLink’s journey and marks an expansion beyond our core business.”

Lubin also shared his enthusiasm for the collaboration, stating, “This is an exciting time for the Ethereum community. I am delighted to work with Rob and the team to bring the Ethereum opportunity to public markets.”

Proceeds from the offering will be used to acquire ETH as a long-term treasury reserve, in addition to funding general corporate and working capital needs. This move positions SharpLink Gaming as one of the first U.S.-listed companies in the iGaming and sports betting space to commit to Ethereum as a reserve strategy, potentially signaling a broader adoption trend among digital-native companies.

Moreover, in a significant development, the SEC recently dropped its lawsuit against Consensys as part of a shift in its regulatory approach to digital assets. This move signifies a positive step towards regulatory clarity in the crypto space and bodes well for the future of blockchain technology.

Overall, the partnership between SharpLink Gaming and Consensys represents a pivotal moment in the integration of blockchain technology and cryptocurrency into the mainstream financial landscape. With Ethereum at the forefront of this transformation, the future looks promising for both companies as they pave the way for innovation in the sports betting and iGaming industry.