Solana’s Rise in December Fueled by Meme Coins and DEX Networks

Solana’s success continued throughout December, with meme coins playing a key role in helping the blockchain gain market share against industry giants like Ethereum.

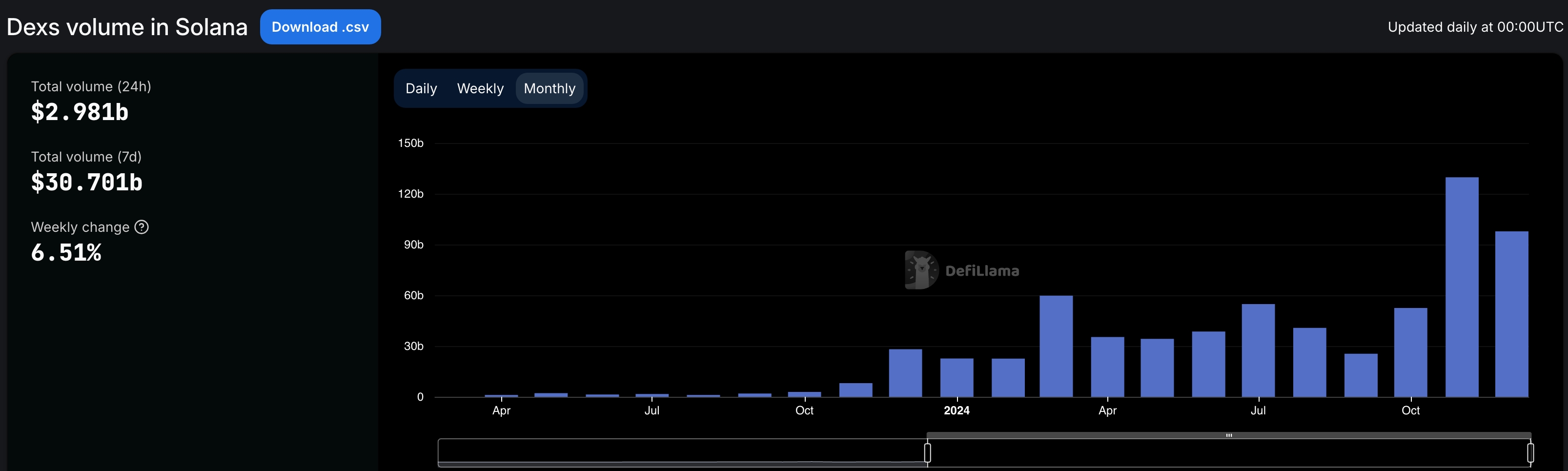

Solana Dominates DeFi Sector

According to DeFi Llama, Solana’s (SOL) decentralized exchange protocols were the most active in December, handling a staggering volume of over $97 billion. This marked a significant increase from the $22.6 billion volume recorded in the same period the previous year.

For the third consecutive month, Solana surpassed Ethereum (ETH) in terms of protocol activity, with Ethereum’s protocols processing over $74 billion in volume, while Base and Arbitrum managed $42 billion and $37 billion respectively.

Meme Coins Drive Solana’s Growth

The surge in Solana’s DEX volume can be attributed to meme coins, with Raydium (RAY) leading the pack by handling coins worth $65 billion in the last month. Other networks like Orca, Lifinity, Pump, and Phoenix also contributed significantly to Solana’s success in the meme coin industry.

Solana’s appeal to meme coin creators and users has resulted in the blockchain hosting a multitude of meme coins with a collective market cap exceeding $14.1 billion. Notable meme tokens such as Bonk, Dogwifhat, Popcat, and Peanut the Squirrel have gained popularity on the Solana network.

Record Revenue for Solana’s Native dApps

The influx of meme coins and increased protocol activity have translated into substantial profits for Solana and its native applications. In November alone, all Solana native dApps generated a record $365 million in revenue, while the blockchain as a whole garnered $725 million in fees in 2024, positioning it as the third most profitable chain after Ethereum and Tron.

Developers and users favor Solana for its lower fees and higher throughput compared to other blockchains, making it an attractive platform for innovation and growth.

Base Emerges as a Strong Contender

Base, the layer-2 network launched by Coinbase, has also made waves in 2024, with its total fees surpassing $82 million. As the largest layer 2 network in the industry, Base’s DEX networks have handled over $181 billion in assets, and its total value locked has soared to $2 billion.

The success of Solana, coupled with the rise of platforms like Base, underscores the growing diversity and competitiveness within the blockchain ecosystem.