The Global Cryptocurrency Market Faces Major Decline Amidst Global Economic Uncertainty

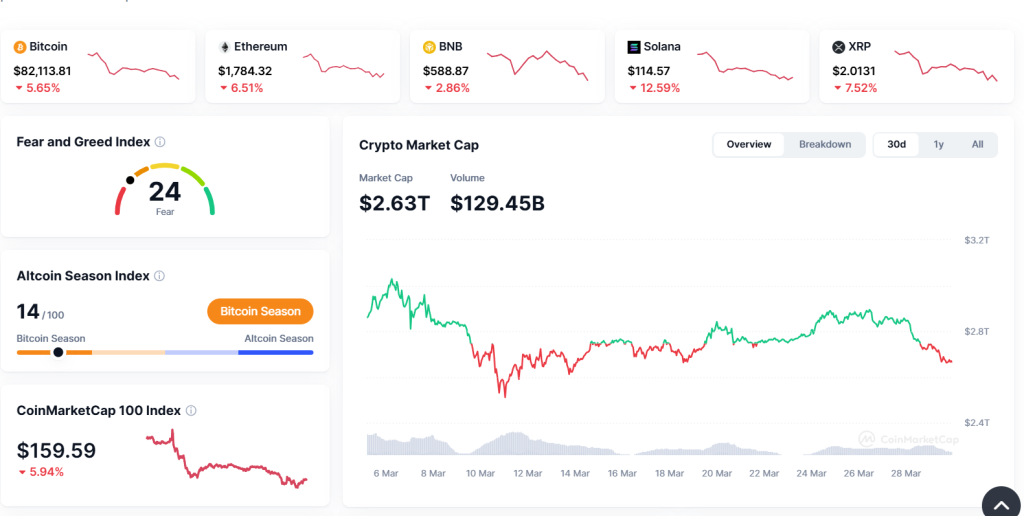

Today, the global cryptocurrency market experienced a significant downturn, with the total market capitalization dropping by 5.46% to $2.63 trillion. This sharp decline was triggered by a widespread sell-off following U.S. President Donald Trump’s announcement of new tariffs on trading partners worldwide, raising concerns about global economic stability.

Bitcoin (BTC) Leads the Downturn

Bitcoin (BTC) led the downturn, falling to $82,274.70—a 5.39% decrease in the past 24 hours and a 5.67% drop over the past week. Ethereum (ETH) also saw a substantial decline, down 6.04% to $1,787.79, while XRP fell 7.76% to $2.00. Other major cryptocurrencies like Binance Coin (BNB) weren’t spared either, slipping 2.94% to $588.96.

Altcoins Face Widespread Losses

The market’s slump was fueled by widespread losses across major altcoins. Cardano (ADA) struggled with a 9.25% drop, now sitting at $0.6315. Other altcoins like Solana (SOL), Dogecoin (DOGE), Toncoin (TON), Chainlink (LINK), Polkadot (DOT), Avalanche (AVAX), Shiba Inu (SHIB), and Hedera (HBAR) all faced declines, with losses ranging from 4.83% to 11.18%.

Stablecoins like Tether (USDT) and USD Coin (USDC) remained steady, showing little price movement as investors sought refuge in these less volatile assets.

Market Sentiment and Outlook

The market’s Fear & Greed Index now sits at 24, signaling extreme fear among investors as the crypto sector reacts to the ripple effects of U.S. trade policy. With global markets under pressure, all eyes are on how digital assets will react in the next few days.

As the global economy faces uncertainty and volatility, the cryptocurrency market remains a key indicator of investor sentiment and market dynamics. Traders and investors are closely monitoring the situation to assess the impact of geopolitical events on digital assets and the broader financial landscape.