Stablecoins have been gaining significant traction in the financial world, with the market crossing the $230 billion mark this week. This surge in value is attributed to the increasing adoption of digital assets and the regulatory efforts being made to govern them effectively.

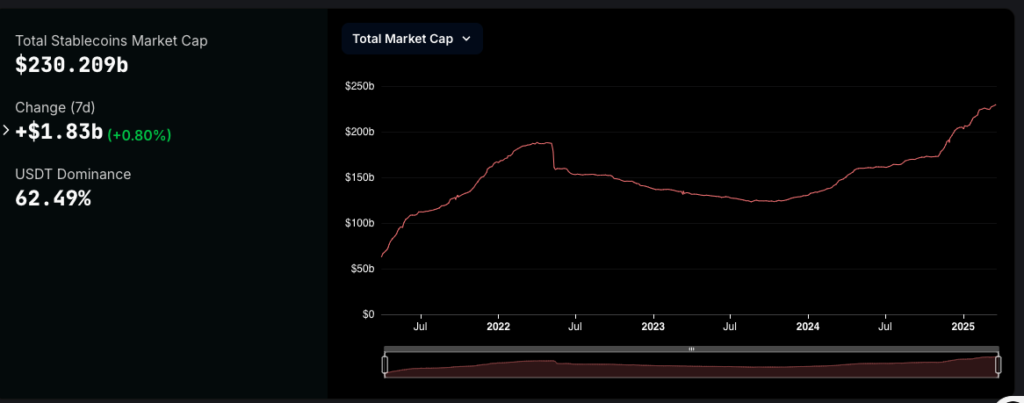

Data from DefiLlama reveals that the stablecoin market cap now stands at $230.2 billion, with a substantial increase of $1.83 billion over the past week. This marks a 72% year-to-date growth from last year’s valuation of $133.25 billion. Tether’s USDT remains the dominant player in the market, holding 62.5% of the total market cap with nearly $144 billion, followed by Circle’s USDC at $59 billion.

The stablecoin market had previously reached a peak of $187.9 billion in April 2022 before experiencing a decline due to various crises in the crypto space. However, the sector has been rebounding since mid-2023 and has been on a steady growth trajectory ever since.

This growth in the stablecoin market has been accompanied by a surge in user adoption and wallet activity. A joint report by Artemis and Dune revealed that active stablecoin wallets have increased by over 50% in the past year, with active addresses growing from 19.6 million in February 2024 to 30 million in February 2025.

Tether’s influence has extended beyond the crypto markets, with the company becoming the seventh-largest buyer of U.S. Treasuries in 2024. According to Tether CEO Paolo Ardoino, the company purchased a net $33.1 billion in U.S. Treasuries last year, surpassing several countries in terms of treasury holdings.

The regulatory landscape surrounding stablecoins is also evolving, with the U.S. government taking steps to define clearer oversight paths for these digital assets. President Donald Trump recently called for Congress to pass stablecoin regulations during the Digital Assets Summit in New York, emphasizing the importance of balancing growth with security.

The Senate Banking Committee advanced the Generating Necessary Information for Uncovering Stablecoins (GENIUS) Act to the full Senate, with the bill proposing that stablecoin issuers with over $10 billion in market cap fall under Federal Reserve oversight. Smaller issuers would remain regulated at the state level, providing a dual oversight structure that aims to offer regulatory clarity without stifling innovation.

Stablecoins are playing an increasingly significant role in the global financial system, accounting for over 1% of the U.S. dollar M2 money supply. Federal Reserve Governor Christopher Waller highlighted the benefits of stablecoins in streamlining cross-border payments and providing access to USD in high-inflation economies.

With regulatory progress shaping the future of stablecoins, investors are advised to consider the evolving legal frameworks and market dynamics to effectively manage potential risks. As stablecoin adoption continues to expand, the integration of digital assets with traditional banking systems is expected to facilitate smoother payment processes and reshape established financial interactions.