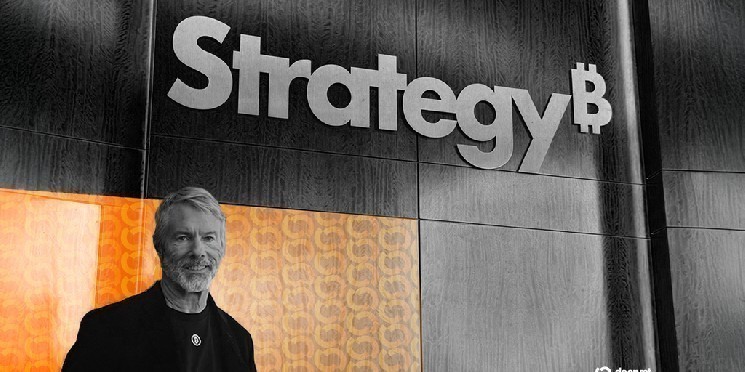

Bitcoin investment company Strategy has successfully dismissed a class-action lawsuit filed against them for allegedly making false and misleading statements regarding their profitability.

The lawsuit was initially brought forth in May, accusing Strategy of deceiving investors about the impact of new crypto accounting practices on their profitability. Strategy, known for transitioning from software development to a Bitcoin accumulation strategy, currently holds over $68 billion worth of BTC.

This year, Strategy adopted a fair value accounting standard, allowing them to reflect quarter-to-quarter fluctuations in Bitcoin prices on their balance sheets. Previously, the company only recorded Bitcoin at its original purchase cost, limiting their ability to mark up price increases unless tokens were sold.

Investors who sued Strategy alleged that the company misrepresented the positive impact of this new accounting strategy on their profitability. When Strategy reported a net loss of $4.22 billion in the first quarter of 2025, despite Bitcoin’s surge in value, shareholders expressed dissatisfaction.

Despite these challenges, the plaintiffs in one of the significant lawsuits against Strategy decided to voluntarily dismiss their claims. The dismissal, filed in a federal court in eastern Virginia with prejudice, signifies that the claims cannot be brought to court again.

Decrypt contacted the plaintiffs’ attorneys for clarification on the dismissal of claims or any potential settlement with Strategy, but did not receive an immediate response.

In recent weeks, Strategy has faced criticism for how they present their unconventional business model to shareholders. A prominent Wall Street advisor recently criticized the company for comparing its price-to-earnings ratio to established companies like Apple and Nvidia, calling it fraudulent due to Strategy’s recent performance being primarily driven by a one-time increase in Bitcoin’s price.