The Latest Trends in Bitcoin (BTC) Holding Patterns

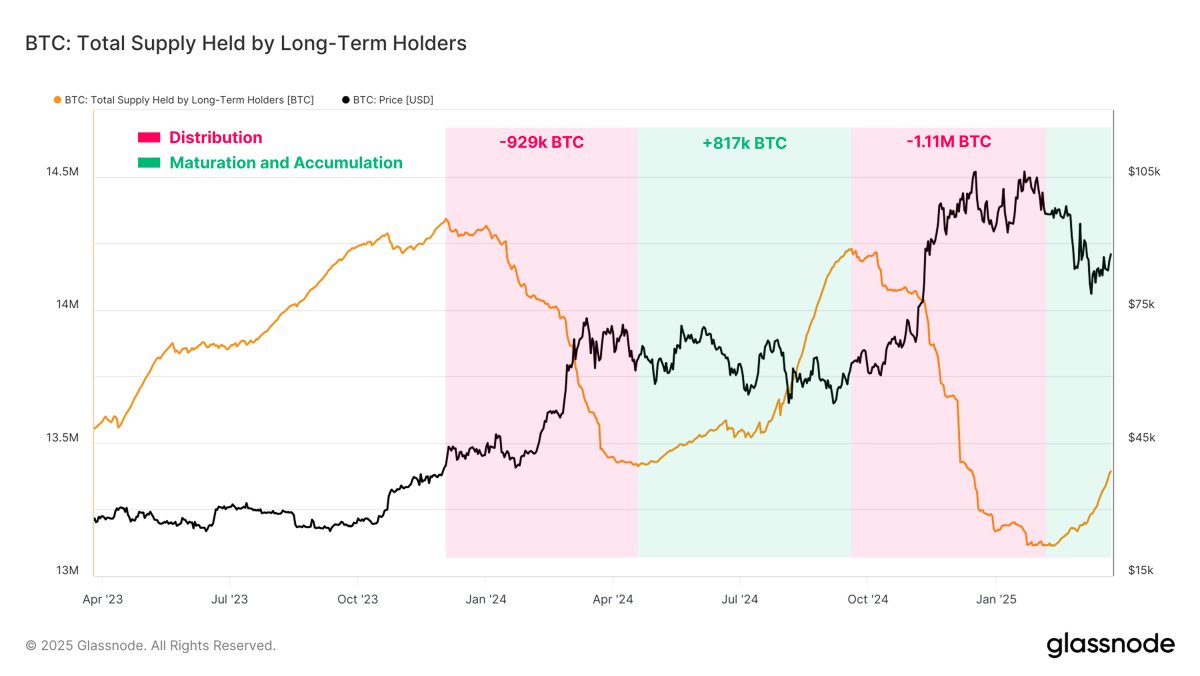

Recent data from digital asset analytics firm Glassnode reveals interesting insights into the behavior of Bitcoin holders, particularly long-term investors. The firm notes a trend where long-term holders, defined as those who have held their coins for more than 155 days, are actively re-accumulating BTC after periods of selling. This re-accumulation is contributing to a reduction in volatility in the price chart.

Re-Accumulation by Long-Term Holders

Glassnode’s analysis shows that long-term holders have distributed over 2 million BTC in two distinct waves during the 2023-25 cycle. However, each wave of selling has been followed by significant re-accumulation, which has helped absorb the sell-side pressure. This cyclical balance in buying and selling activities may be playing a role in stabilizing the price action of Bitcoin.

Increasing Hesitancy Among New Long-Term Holders

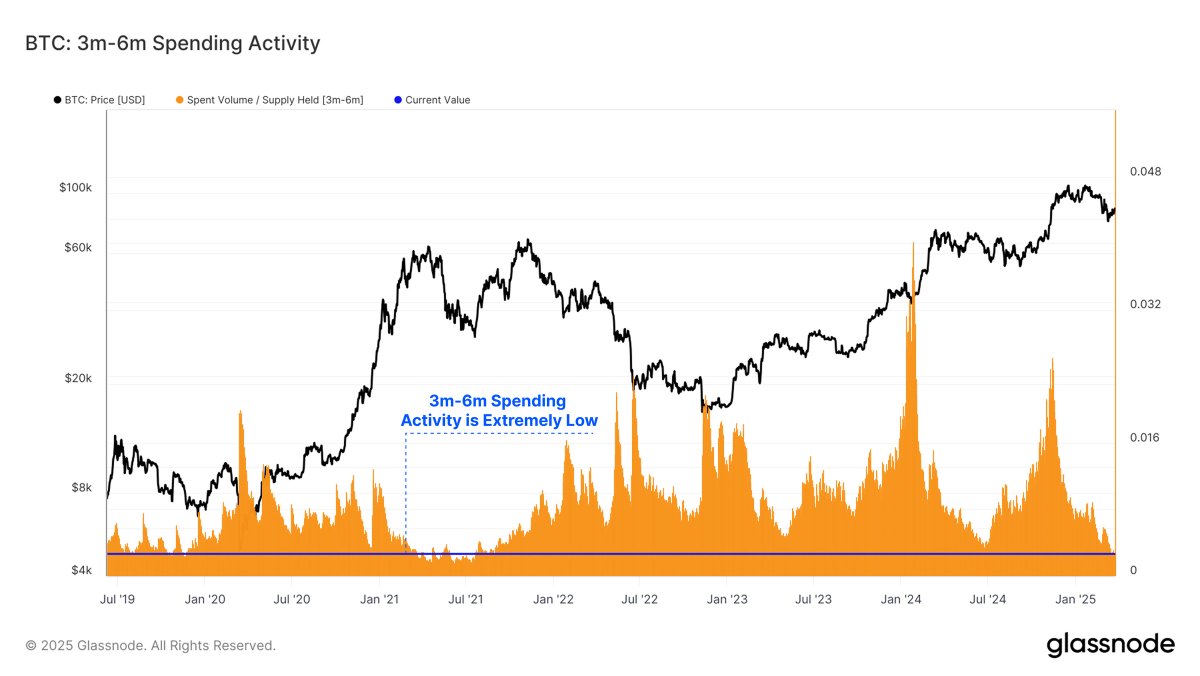

Furthermore, Glassnode reports that Bitcoin holders who are approaching long-term holder status are exhibiting a reluctance to sell their holdings. The data shows a sharp rise in the wealth held by holders in the three to six-month range, indicating a growing conviction in their positions. Despite acquiring their coins near all-time high levels, these holders are showing a commitment to their investments rather than capitulating.

Market Strength of Bitcoin Holders

Moreover, Glassnode highlights that the selling activity among Bitcoin holders in the three to six-month range has reached its lowest level in nearly four years. This low level of spending suggests relative market strength, as holders are holding onto their positions despite recent market volatility.

As of the time of writing, Bitcoin is trading at $85,151, reflecting a 2.3% increase in the last 24 hours. These trends in holding patterns and re-accumulation by long-term holders indicate a growing confidence in the future of Bitcoin among investors.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Featured Image: Shutterstock/prodigital art