Sui’s Rise in Market Cap Fueled by DeFi and Gaming Sectors

Sui has experienced a significant market cap rebound of over 10% in the past 24 hours, driven by its expanding presence in the DeFi and gaming sectors.

On-chain analytics platform Santiment reports that Sui’s market cap growth is attributed to new partnerships, staking rewards, and a surge in bullish sentiment on social media, reaching its highest level since September.

With a remarkable price surge of 259% over the last five months, Santiment cautions against rising FOMO (fear of missing out) potentially causing short-term price spikes and subsequent retracements.

https://twitter.com/santimentfeed/status/1889927219037790273?s=46&t=nznXkss3debX8JIhNzHmzw

The influx of stablecoin market capitalization on Sui, reaching a record high of $500 million according to DefiLlama data, has also contributed to the recent market recovery. This influx signifies a rise in liquidity entering the Sui network, indicating heightened interest and activity on the platform.

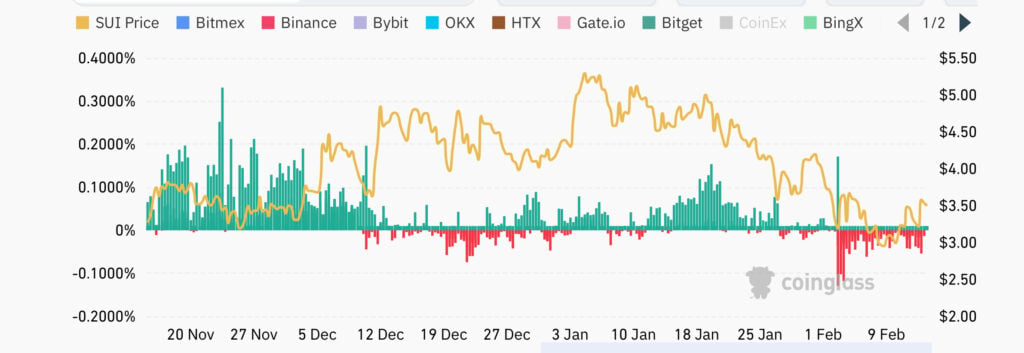

Additionally, Sui is showing strength in the derivatives market as evidenced by a positive funding rate for SUI after a week of negatives. The total value of open interest contracts has surged to $451.3 million, suggesting growing trader optimism that could potentially drive Sui’s price higher if the trend persists.

Sui has carved a niche for itself as a blockchain platform that combines the advantages of web3 with the user-friendly interface of web2. Its low fees and swift transactions have attracted the attention of DeFi projects and the gaming industry, both of which are expanding rapidly on the network. Moreover, Sui has secured partnerships with key institutional players like Franklin Templeton, Grayscale, Libre Capital, and Copper.

While it remains uncertain whether market pressures will ease in the coming weeks or if SUI can sustain its current momentum in the long run, the platform’s growth in the DeFi and gaming sectors bodes well for its future prospects.