Stablecoin Issuer Tether Emerges as Top CeFi Lender in Digital Asset Space

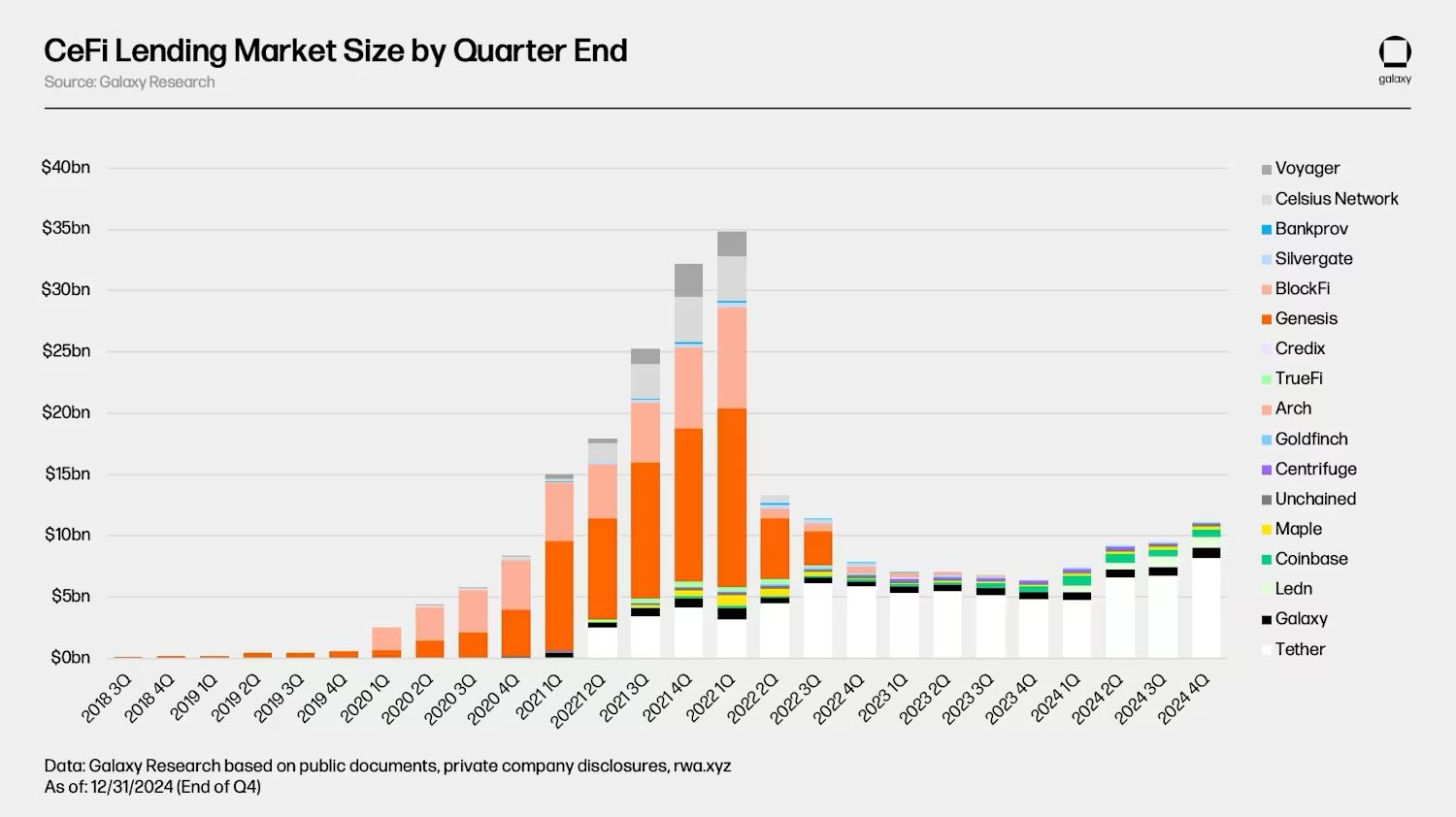

According to recent analysis, Tether, the stablecoin issuer, has secured its position as the largest centralized finance lender (CeFi) in the digital asset realm. The research conducted by Zack Pokorny, a research analyst at Galaxy Digital, revealed that Galaxy and Bitcoin lending firm Ledn followed closely as the second and third-largest lenders in the industry.

Market Overview

As of the fourth quarter of 2024, the combined loan book of Tether, Galaxy, and Ledn amounted to $9.9 billion, representing nearly 89% of the CeFi lending market and 27% of the total crypto lending market. Interestingly, Coinbase, a prominent US crypto exchange, secured the fourth position in terms of loan book size.

Insights from Galaxy Digital

Alex Thorn, the head of research at Galaxy, highlighted that the total CeFi loan book size by the end of 2024 stood at $11.2 billion, marking a 68% decrease from the all-time high of $34.8 billion recorded in 2022.

Decentralized Finance (DeFi) Landscape

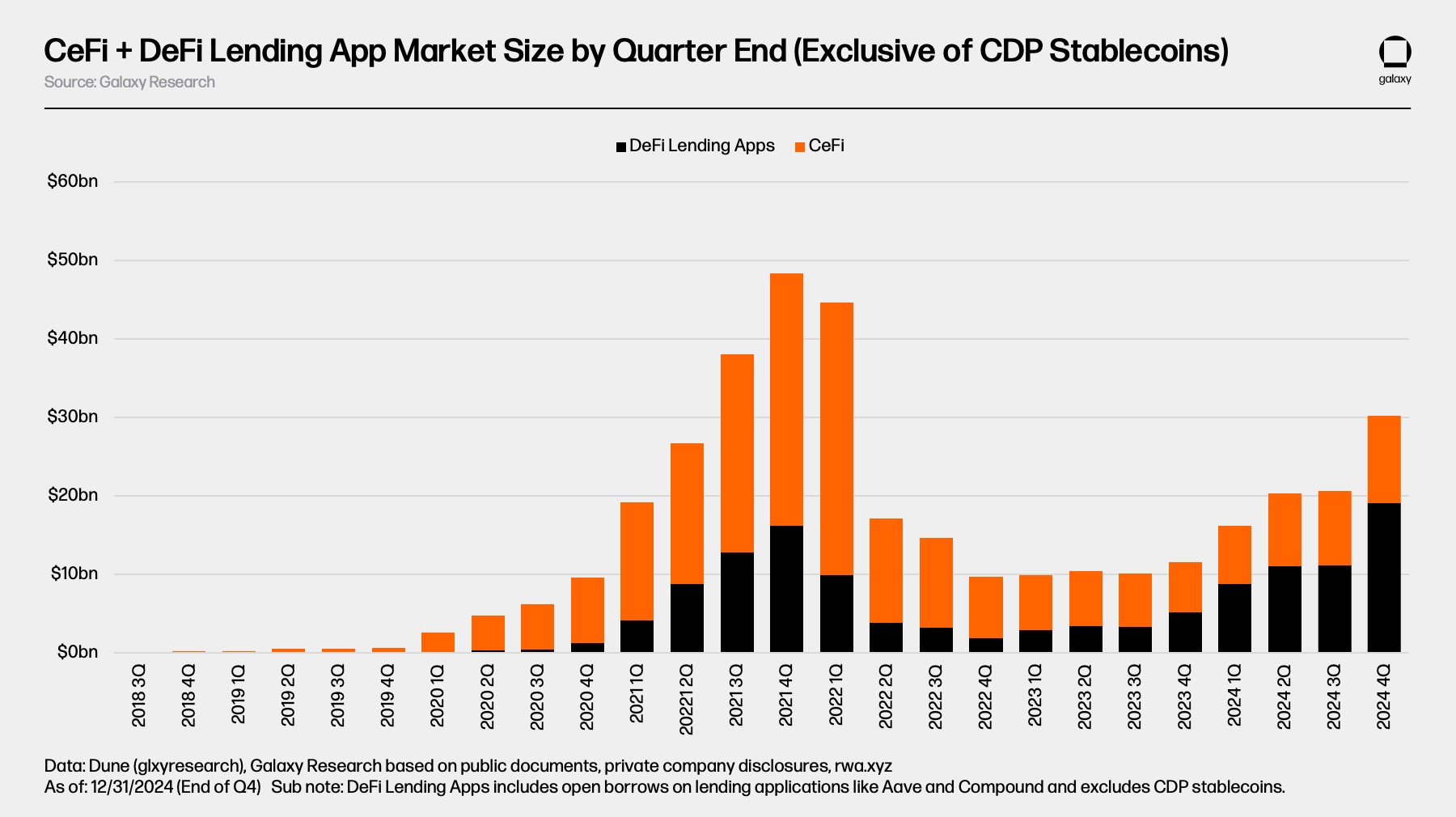

Contrasting the CeFi sector, decentralized finance (DeFi) showcased a larger lending sector, with open borrows totaling $19.1 billion across 20 lending applications and 12 chains by the end of 2024. Pokorny noted that DeFi lending witnessed a significant 959% increase since its lowest point two years prior.

“DeFi borrowing has experienced a stronger recovery compared to CeFi lending, attributed to the permissionless nature of blockchain-based applications and the resilience of lending platforms during market downturns. Unlike major CeFi lenders that faced bankruptcy, leading DeFi lending applications continued to operate, showcasing the benefits of algorithmic, overcollateralized, and demand-based borrowing.”

Stay Updated with The Daily Hodl

For more insights and news on the cryptocurrency market, follow us on X, Facebook, and Telegram. Subscribe to our email alerts to receive the latest updates directly to your inbox.

Don’t miss out on tracking price action and exploring The Daily Hodl Mix for a diverse range of content.

Generated Image: Midjourney