Crypto Analytics Firm Swissblock Predicts End of Bearish Trend for Bitcoin

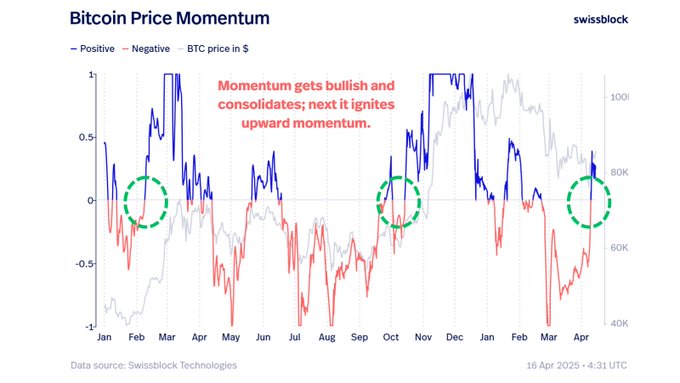

According to Swissblock, a leading crypto analytics firm, the bearish trend for Bitcoin (BTC) may be coming to an end. The firm suggests that Bitcoin’s bearish structure is starting to crumble as it breaks out of a bearish compression pattern into a bullish quadrant, indicating potential upward price momentum.

A recent tweet from Swissblock stated, “Historically, this signals more upside, even a brief dip won’t stop it.”

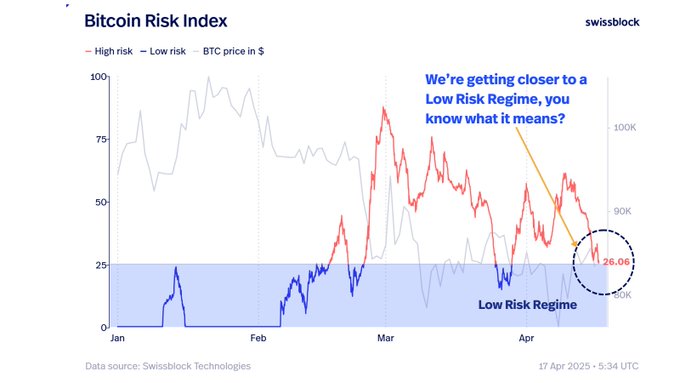

Swissblock also noted that Bitcoin’s price remained stable while equities were declining earlier in the week. The firm predicts a low-risk environment that favors risk assets is approaching, setting the stage for Bitcoin’s potential rise. However, Swissblock suggests that before climbing, Bitcoin could experience a minor dip of around 5% to approximately $80,000.

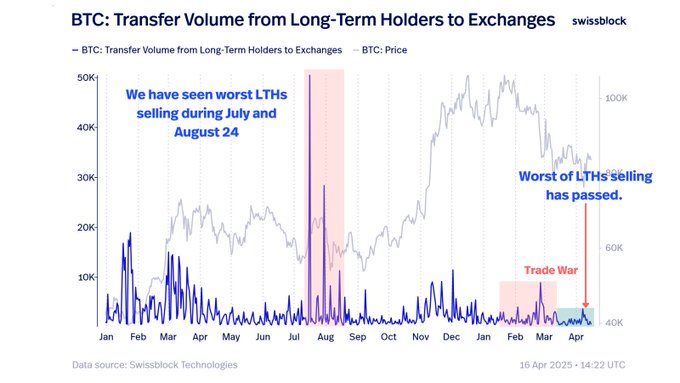

Furthermore, Swissblock reports that long-term Bitcoin holders are holding onto their assets and not succumbing to fear-induced selling. Data from Swissblock Technologies indicates that the recent sell-off by long-term holders was less severe compared to previous instances in July and August of 2024.

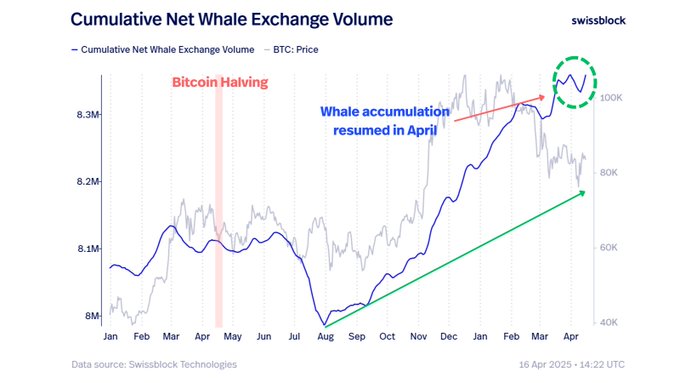

Regarding Bitcoin whales, Swissblock reveals that large BTC holders have increased their holdings to a one-year high after resuming accumulation activities this month. The firm states, “Whales are back, nearing all-time high BTC holdings since the halving. Strong hands are accumulating faster, holding price but, of course, waiting for the best bid.”

Bitcoin underwent its fourth halving on April 19th, 2024, and is currently trading at $84,490. The outlook appears positive for the leading cryptocurrency.

Follow us on X, Facebook, and Telegram for more updates.

Stay informed with email alerts and check out the latest price action on The Daily Hodl Mix.

Featured Image: Shutterstock/Everyonephoto Studio/Chuenmanuse