Theta Network (THETA) Gains Traction Amidst Market Uncertainty

Theta Network’s native token, THETA, is currently attracting the attention of crypto traders due to a bullish price action pattern forming on its daily timeframe. This comes at a time when the broader cryptocurrency market is facing challenges, with major assets like Bitcoin, Ethereum, and XRP struggling.

Despite the market uncertainty, THETA’s bullish outlook is supported by increasing interest from traders and sustained accumulation by whales. These positive developments are unfolding as the price reaches a critical level near the breakout point.

Technical Analysis and Key Levels for Theta Network (THETA)

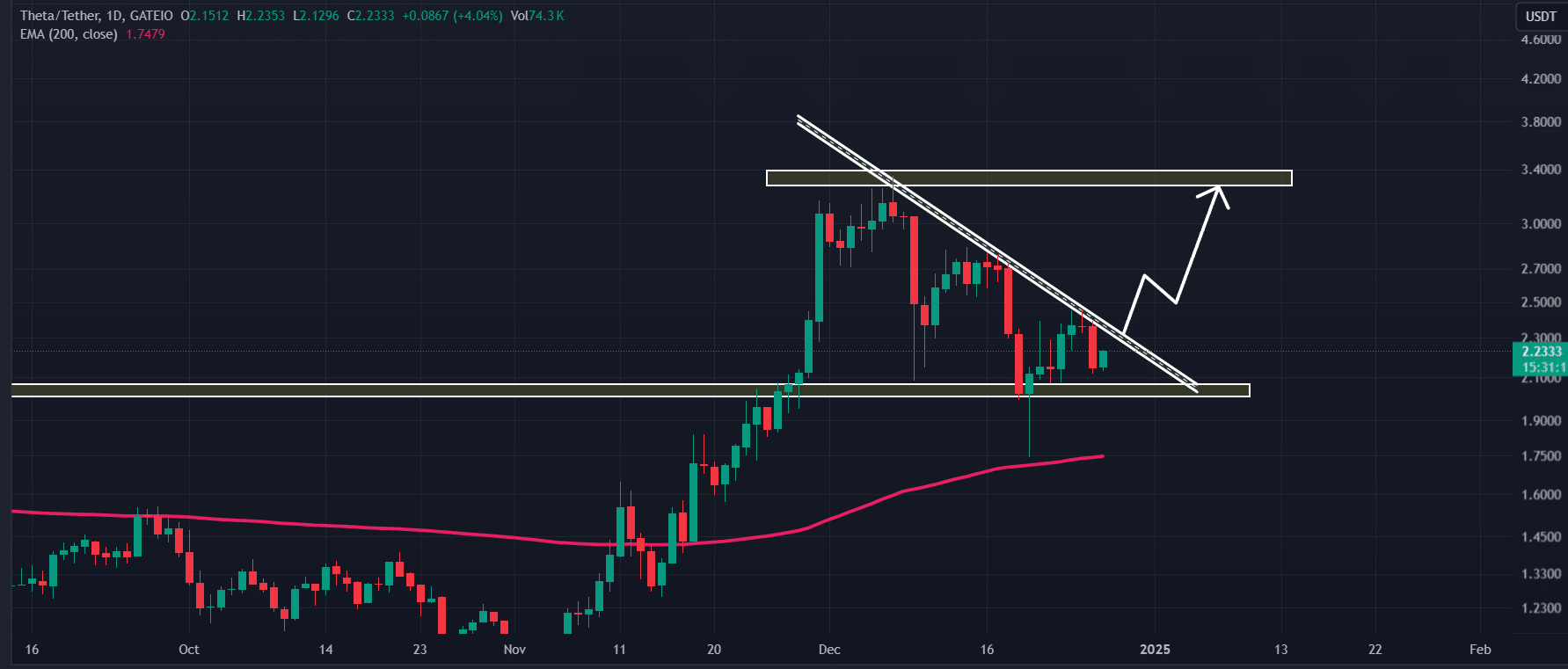

AMBCrypto’s technical analysis reveals that THETA has formed a descending triangle price action pattern on the daily timeframe, signaling a potential breakout. Following a recent price correction, the token successfully retested crucial support from the 200 Exponential Moving Average (EMA) on the same timeframe.

Source: TradingView

If THETA breaks out from the pattern and closes a daily candle above the $2.41-mark, there is a strong possibility of a 37% surge to reach $3.33 in the future. Additionally, THETA’s Relative Strength Index (RSI) at 43 indicates potential for upside momentum.

Bullish On-Chain Metrics for THETA

On-chain analytics firm Coinglass reports bullish on-chain metrics for THETA. Data from THETA’s spot Inflow/Outflow shows significant outflows of $2.02 million from exchanges to long-term holders’ wallets in the last 24 hours, indicating potential buying pressure and upside momentum.

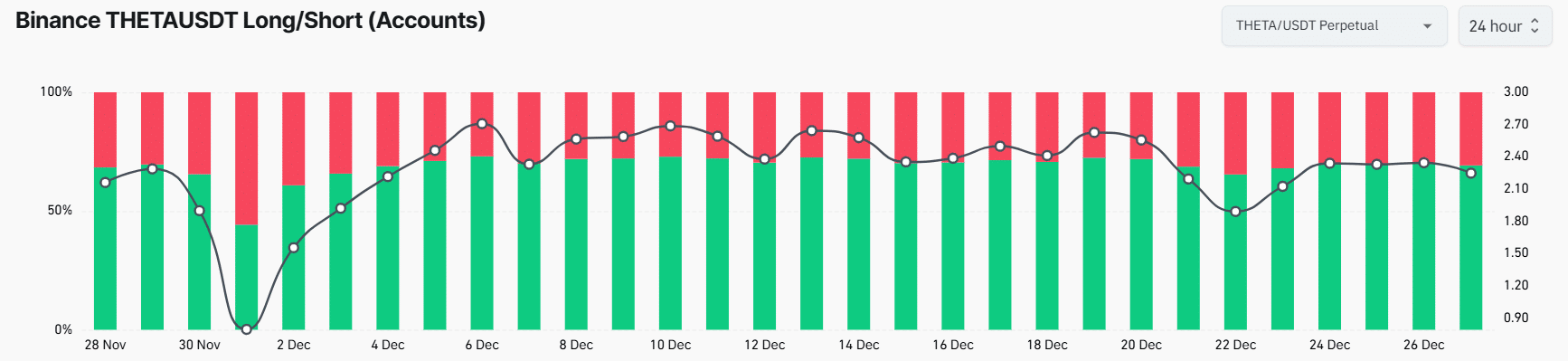

Furthermore, traders on Binance are showing strong interest in THETA, with the Binance THETAUSDT long/short ratio at 2.25, reflecting bullish sentiment among traders. Currently, 69.2% of top traders on Binance hold long positions in THETA.

Source: Coinglass

Current Price Momentum for THETA

As of the latest update, THETA is trading near $2.21, with a 1% price decline in the last 24 hours. However, trading volume has decreased by 5.75%, indicating lower participation from traders compared to the previous day.