A recent surge in whale activity surrounding CAKE, the native token of PancakeSwap, has caught the attention of market participants, hinting at a potential market bottom and a significant buying opportunity.

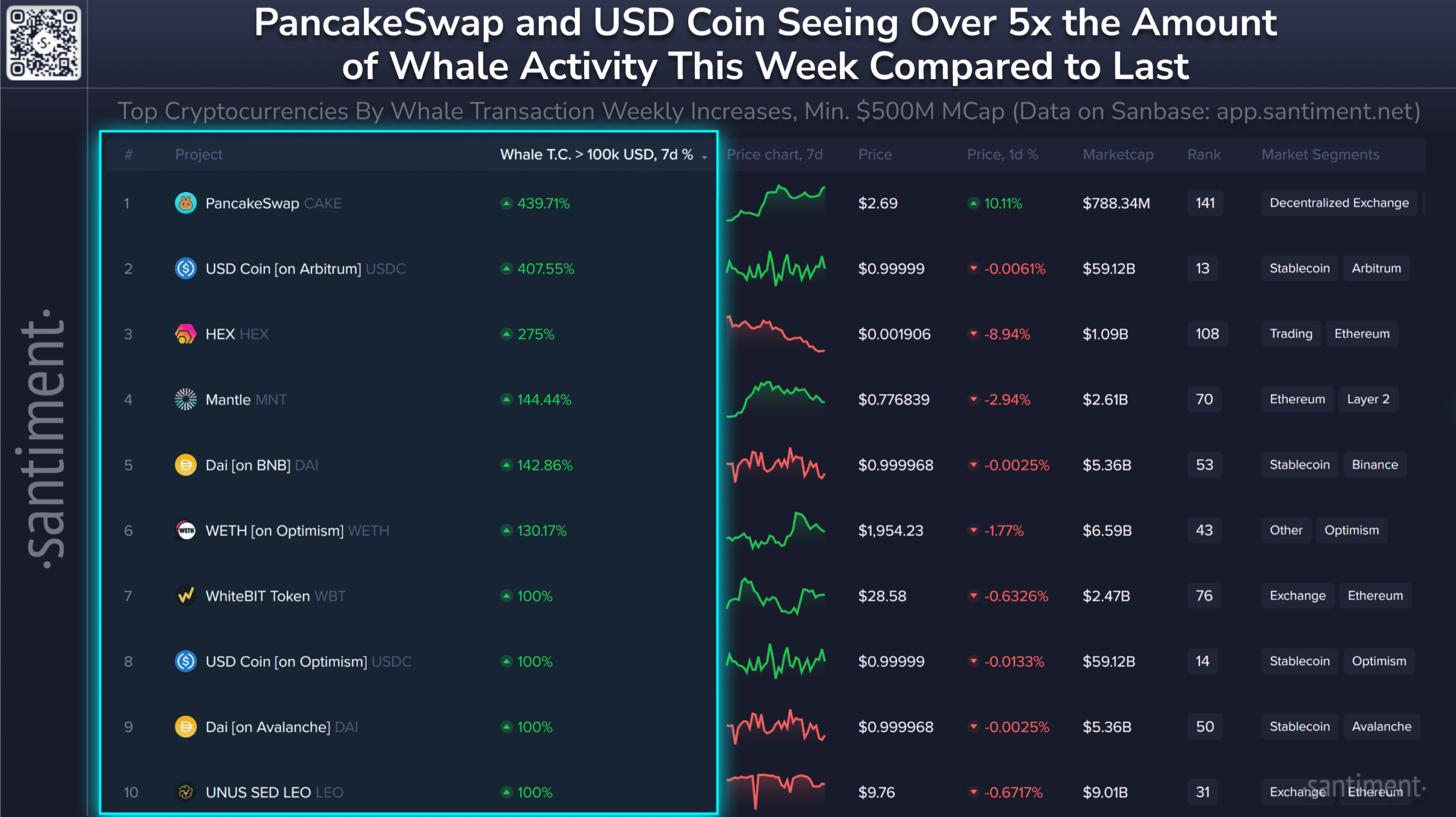

CAKE Whale Activity Surges by 440%

Data from the on-chain analytics firm Santiment has shown a staggering 440% increase in whale activity related to CAKE in the past week. This surge in whale activity indicates a potential shift in sentiment and could lead to a substantial uptrend in the asset.

Source: Santiment

This surge in whale activity has already propelled CAKE upwards by 38% in the past week, setting the stage for a potential breakout.

PancakeSwap Technical Analysis and Price Prediction

As CAKE approaches a crucial resistance level at $3, technical analysis suggests a bullish outlook for the asset. If the price manages to breach this resistance and close above $3, CAKE could see a significant surge of up to 40%, reaching the $4.25 level in the near future.

Source: TradingView

At present, CAKE is trading above the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating a bullish trend. The current price of CAKE is around $2.62, with a slight increase of 0.65% in the past 24 hours.

However, a decline in trading volume by 55% suggests lower participation from traders, likely due to increased volatility in the crypto market.

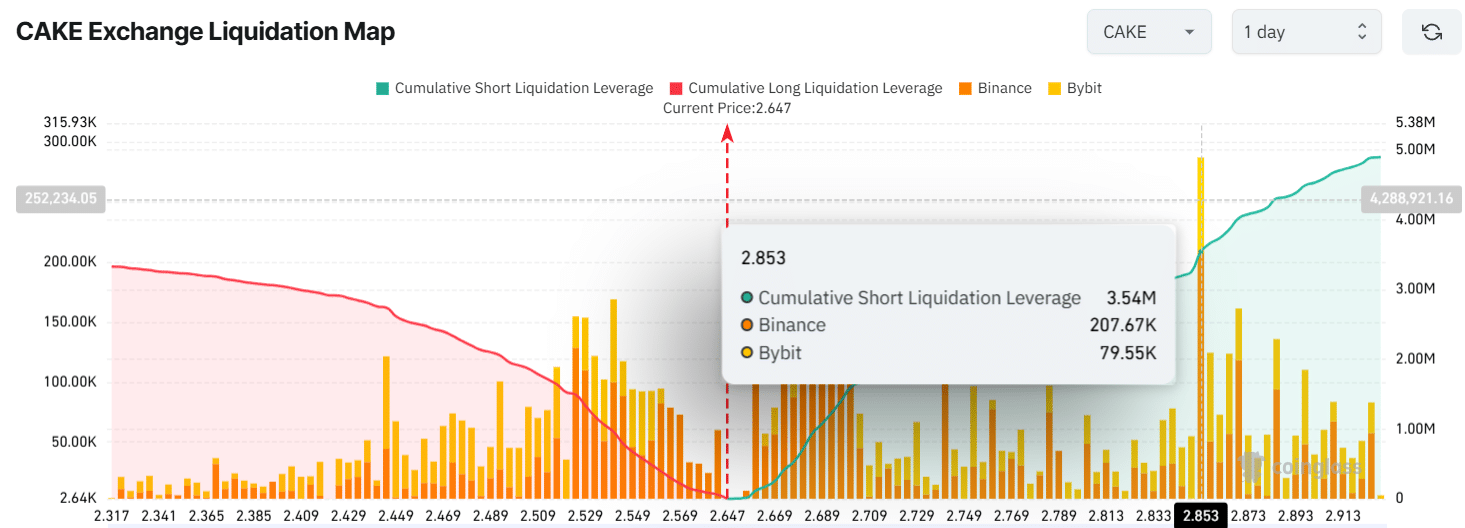

Traders’ Over-Leveraged Levels

Despite the positive price action, traders seem to have a bearish outlook on CAKE, with indications of over-leveraged positions on both the long and short sides. Traders are placing over-leveraged bets at key levels such as $2.445 and $2.85, suggesting a mixed sentiment in the market.

Source: Coinglass

With conflicting signals from whale activity, technical analysis, and traders’ positions, the future price action of CAKE remains uncertain. Investors and traders should closely monitor key levels and market dynamics to make informed decisions.