TRON Surpasses Ethereum in Stablecoin Transactions: A Detailed Analysis

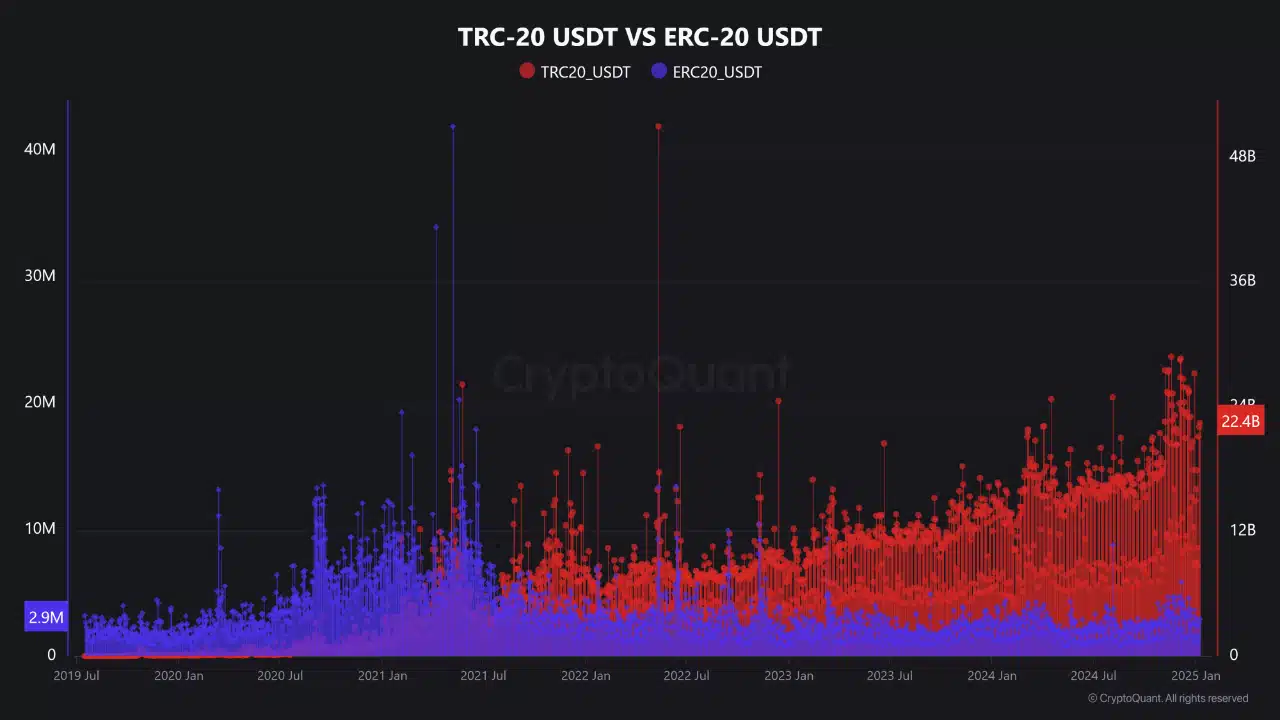

- USDT on TRC-20 total transfers hit 22 billion, outstripping ETH’s ERC-20 USDT at 2.6 billion.

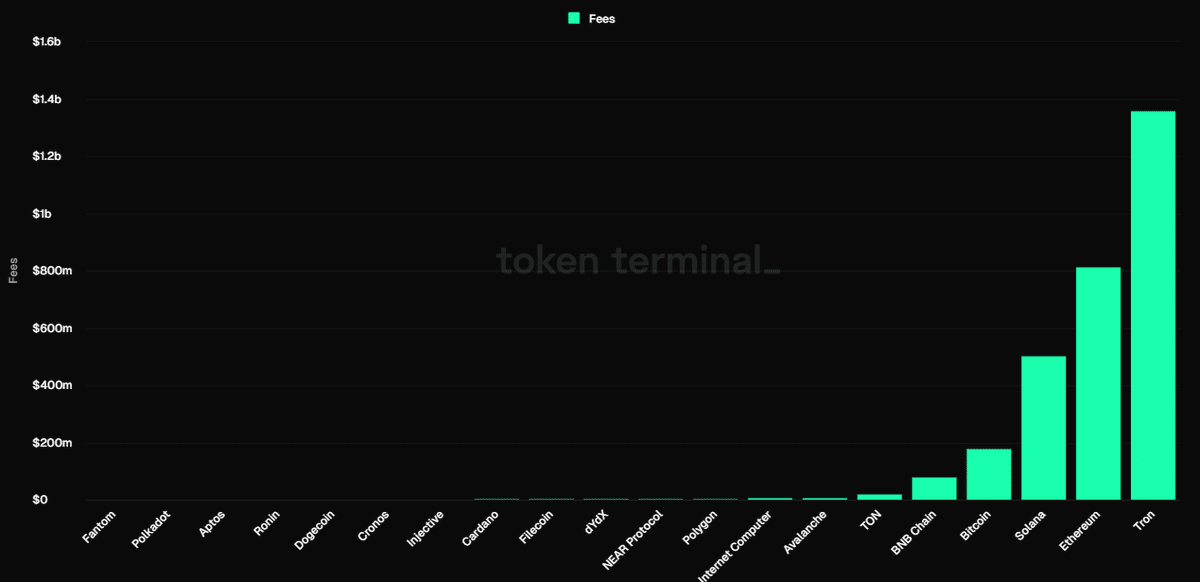

- TRON ranked top among L1 blockchains by fee generated over the last six months

A comparative analysis of TRC-20 and ERC-20 USDT transactions has revealed TRON’s dominance in the stablecoin sector since 2021. The data clearly shows that TRC-20 USDT transactions have surged to 22 billion, significantly surpassing ERC-20’s 2.6 billion.

TRC-20 consistently displayed higher transaction volumes compared to its Ethereum counterpart, with noticeable peaks in mid-2024. This trend underscores TRON’s competitive edge in terms of lower fees and faster processing times, making it a preferred choice for stablecoin transactions among users and exchanges.

Source: CryptoQuant

The significant spike in TRC-20 transactions in September, nearly doubling those on ERC-20, highlights TRON’s efficiency and growing user base. This robust performance reinforces TRON’s leading position in the stablecoin market, showcasing a sustained preference among digital asset operators.

TRON Fee Revenue and TVL

Moreover, TRON’s fee revenue generated over the last six months has reached $1.36 billion, positioning it among the top Layer 1 blockchains, surpassing Ethereum once again. Despite the average fees of $1.2, TRON continues to witness a surge in USDT transactions, indicating its increasing dominance in stablecoin transactions.

Source: Token Terminal

This uptrend in transactions aligns with a notable increase in daily active accounts on TRON, exceeding 2.62 million with an average of 174,000 new accounts daily. This surge has propelled TRON’s total value locked (TVL) to surpass $23.4 billion, showcasing its growing influence and user trust.

The escalating activity on TRON, coupled with its efficient transaction processing capabilities, indicates a potential upward trajectory for TRON, solidifying its position in the blockchain ecosystem and possibly leading to a rise in market valuation.

AI Integration and Price Prediction

Furthermore, the integration of AI technology on TRON could attract more investor interest and speculative trading, potentially driving the price higher in the medium term. Justin Sun’s announcement on X hints at groundbreaking AI developments on TRON and Steemit.

“Some groundbreaking AI will be developed on TRON and Steemit. Stay tuned.”

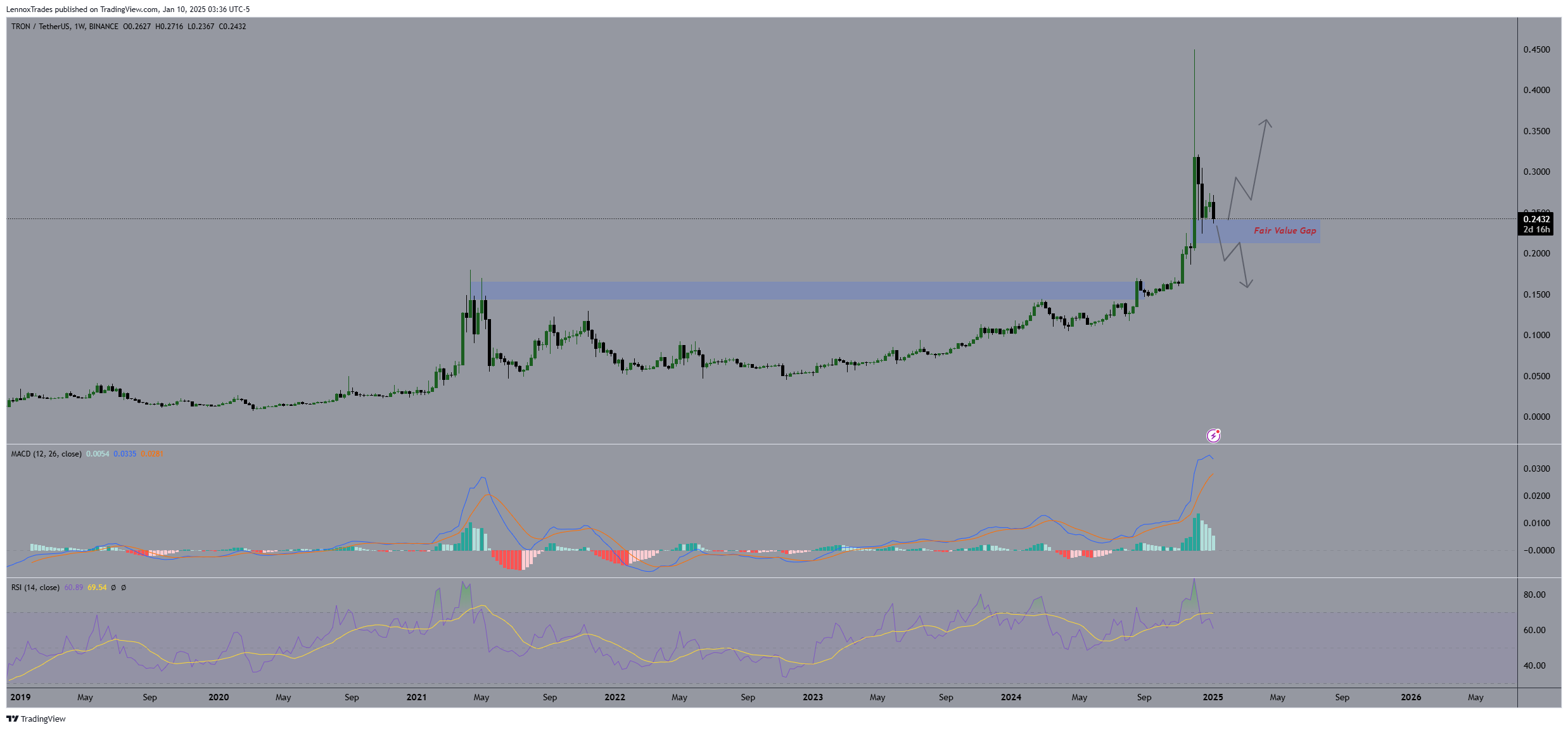

Analysing TRX’s price movement on the weekly timeframe shows a spike to $0.30 followed by a retracement to a support level around $0.24, serving as a pivot point for potential price directions.

Source: Trading View

At the time of writing, the MACD indicator is positive, indicating potential upward momentum, while the RSI nearing 70 suggests TRX is approaching overbought levels, hinting at a possible consolidation or pullback. The price could retest the $0.30 peak or fall back to lower support levels if $0.24 fails as support.