The recent announcement by President Donald Trump regarding reciprocal tariffs on over 100 countries has sent shockwaves through the cryptocurrency market. Investors have reacted swiftly, moving large amounts of Bitcoin, Ethereum, and XRP into exchanges before and after Trump’s speech, signaling a strong intent to sell.

Bitcoin, which was trading at an intraday high of $88,500, plummeted to $83,000 following the announcement. Ethereum also saw a significant drop of 6% to $1,820, while XRP declined by 5% to $2.00. These losses were exacerbated by bearish conditions that had already been brewing in the market.

CryptoQuant reports that Bitcoin open interest dropped from 334,000 to 304,000 BTC, indicating that traders were closing long positions to take profits or avoid losses. Similarly, Ethereum open interest fell by 100,000 ETH, reflecting a similar trend in the derivatives market.

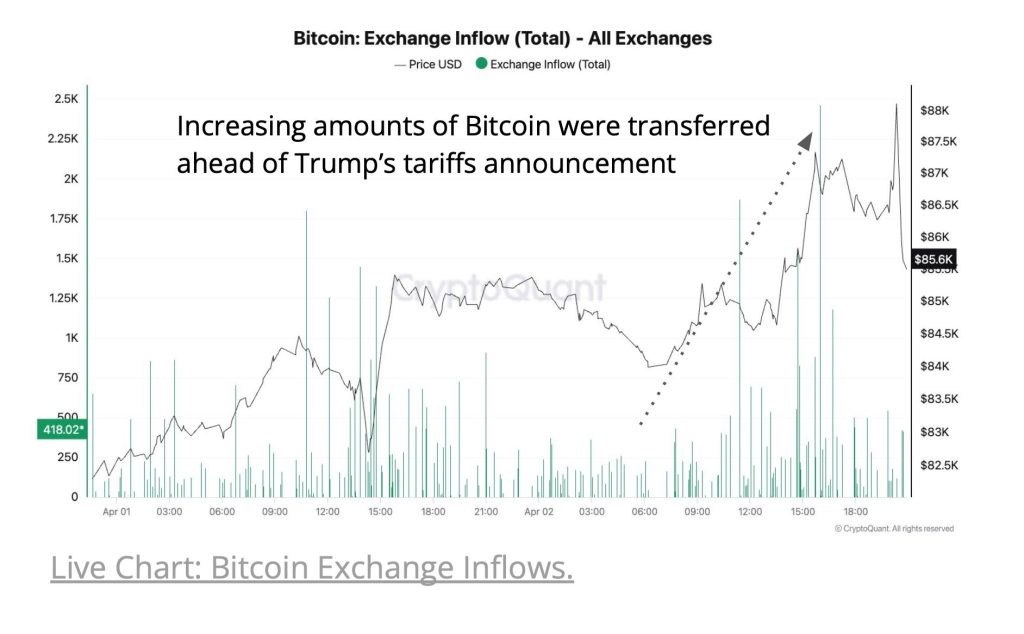

Exchange inflows spiked as investors rushed to sell their holdings in response to the economic uncertainty spurred by Trump’s trade policy shift. On-chain data from CryptoQuant revealed a notable increase in Bitcoin, Ethereum, and XRP deposits into exchanges, showing heightened selling pressure.

Futures market also saw profit-taking and position closures as traders unwound their long positions to secure profits. The decrease in open interest in a declining market often signals long liquidations or profit-taking, reinforcing the downward momentum.

Bitcoin’s Bull Score Index fell to 20, marking its lowest reading since January 2023. A Bull Score below 40 for an extended period indicates sustained bearish conditions, suggesting that the crypto market may face challenges in regaining bullish momentum in the near term.

Trump’s announcement of reciprocal tariffs aims to reshape global trade by imposing a baseline 10% tariff on all imports. While the policy is intended to reduce trade imbalances and bolster domestic production, analysts warn that it could provoke retaliation from trading partners, leading to new trade disputes.

The coming weeks will reveal whether Trump’s tariff gambit will succeed in reshoring jobs or if it risks sparking inflationary pressures that could impact consumer spending and economic growth. In the meantime, the cryptocurrency market remains in a state of flux as investors navigate the uncertain economic landscape.