Uniswap’s Price Surge: What’s Driving the Rally?

Uniswap’s price has seen a significant uptick, breaking through a key resistance level and attracting attention from crypto experts who foresee further gains in the near future.

Uniswap’s (UNI) token has soared to $19.44, reaching its highest point since December 2021, as the momentum in the crypto market continues to strengthen.

This surge in price aligns with the increasing activity on decentralized exchange (DEX) networks. Data shows that DEX platforms processed over $372 billion in token trades in November, marking a record-breaking month for the industry.

Uniswap alone has handled a volume of $30.86 billion in the past week, solidifying its position as the leading player in the market. Its trading volume surpasses that of competitors such as Raydium and PancakeSwap combined. Since its inception, Uniswap has facilitated over 465 million trades valued at more than $2.36 trillion.

Investors are also keeping an eye on the upcoming launch of UniChain, Uniswap’s independent Layer-2 chain. UniChain aims to streamline cross-chain trading on a single platform and is currently in the testing phase, with a planned launch in early 2025.

Additionally, there is speculation that the Trump administration may drop the case filed against Uniswap by the Securities and Exchange Commission (SEC). The SEC had accused the platform of offering unregistered securities on its platform.

Uniswap Price Analysis

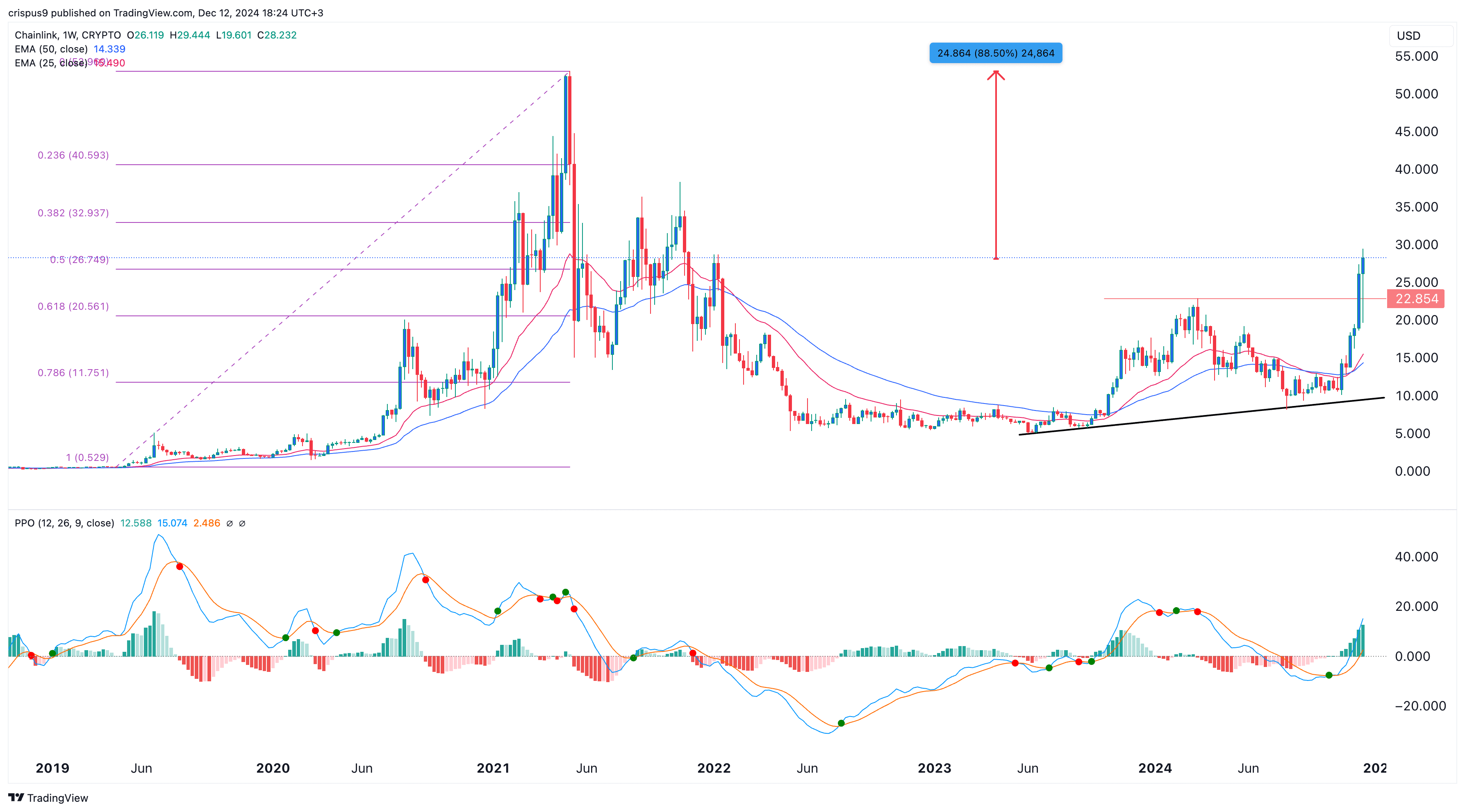

A closer look at the weekly chart shows that UNI has formed a slanted triple-bottom pattern, indicating a bullish reversal. The price has broken above the pattern’s neckline at $17.13, signaling bullish momentum.

UNI is approaching the 38.2% Fibonacci Retracement level at $19.23 and has crossed above the 50-week moving average. Both the MACD indicator and Relative Strength Index are trending upwards, further supporting a bullish outlook.

Analysts, like Crypto Tigers, predict a long-term target of $50 for UNI, representing a potential 180% increase from its current level. To reach this target, Uniswap’s price will need to surpass the 50% retracement point at $24 and break its all-time high of $45.

The path ahead for Uniswap appears to be paved with bullish sentiment, as investors anticipate further gains in the coming weeks.