Following a recent downtrend, XRP is showing signs of a potential breakout from its extended consolidation phase, approaching a crucial resistance level. The main catalyst behind this optimistic outlook is the overall recovery in the cryptocurrency market.

XRP’s Price Momentum

Benefiting from the shift in market sentiment, XRP has experienced a 2.50% surge in the last 24 hours, currently hovering around the $2.51 mark. This upward movement has propelled the asset towards the upper limit of its consolidation range at $2.54.

If the current market sentiment persists, there is a strong likelihood that XRP could surpass this longstanding barrier and surge by 30% to reach $3.32.

XRP Key Levels and Over-Leveraged Positions

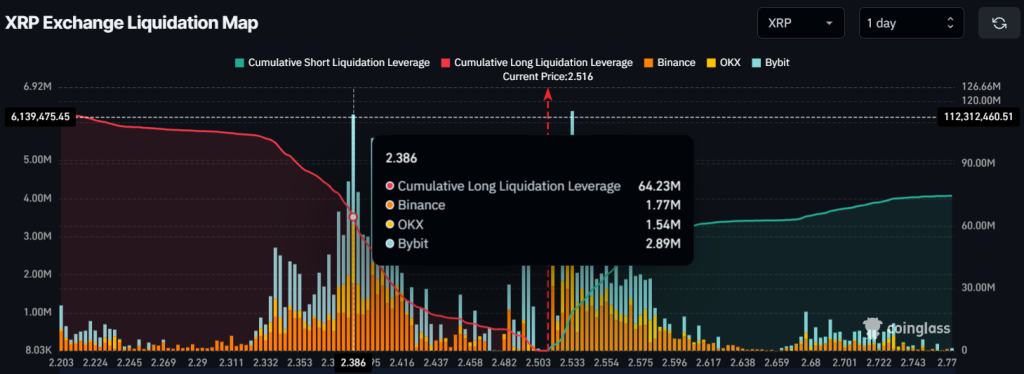

Analyzing the bullish scenario, intraday traders holding long positions have dominated XRP, maintaining substantial open positions over the past day.

Data indicates that long positions are over-leveraged at $2.386, with traders accumulating $65 million in long positions. Conversely, $2.533 marks another critical level where short positions are over-leveraged, currently holding $20 million worth of short positions.

Assessing the current XRP price in relation to the liquidation threshold, it appears that $20 million in over-leveraged positions is at risk of liquidation as the price nears $2.533. A potential liquidation at this level could pave the way for XRP to achieve its projected target due to minimal opposition from short traders.