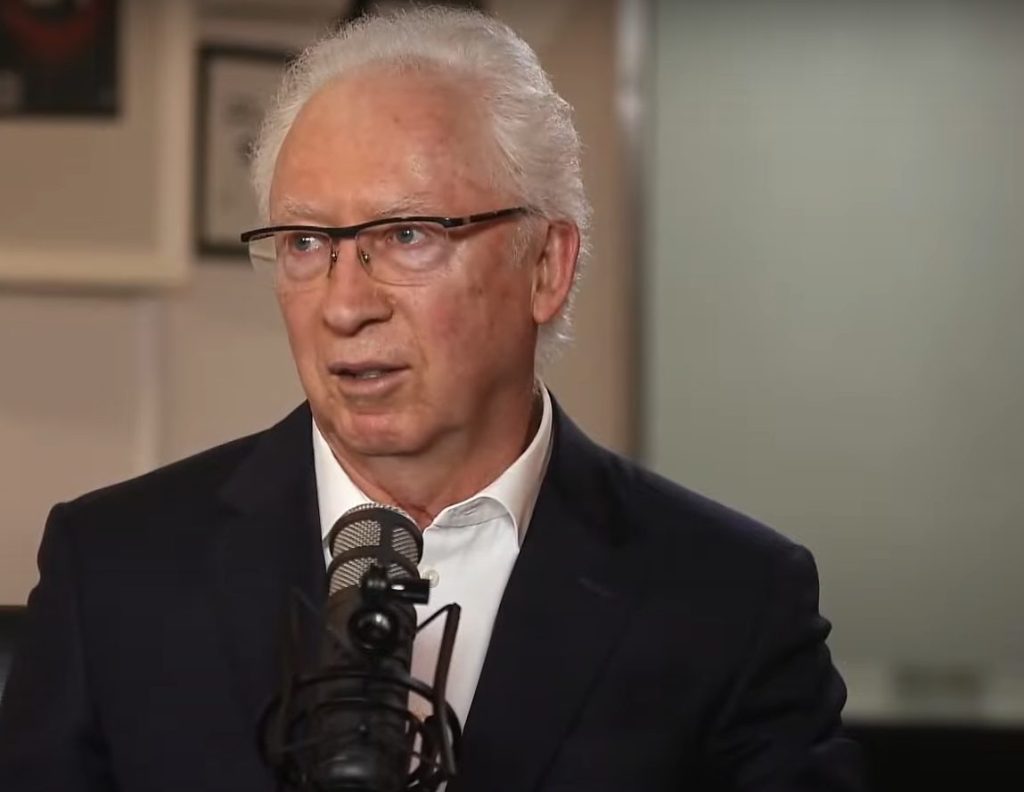

A prominent Russian economist has recently suggested that the adoption of cryptocurrencies in Moscow could have had a significant impact on the stability of the ruble in recent months. Oleg Vyugin, a Professor at the National Research University Higher School of Economics (HSE) and former head of the Russian Federal Financial Markets Service, made these claims during a conference on investments and trading.

Vyugin pointed out that the rise in foreign trade settlements conducted by Russian companies using cryptocurrency may have contributed to the stabilization of the ruble. By engaging in crypto transactions, these companies are able to bypass traditional hard currencies like the US dollar, reducing the demand for such fiat currencies in the market. This shift in payment methods could be one of the factors influencing the stability of the ruble, according to Vyugin.

While acknowledging that his claims are speculative, Vyugin also suggested that the adoption of cryptocurrencies could be impacting the demand for other fiat currencies, including the Chinese yuan. The exchange rate of the yuan on the Moscow Exchange has been steadily decreasing over the past few months, indicating a potential shift in currency preferences among traders and investors.

In addition to the impact on foreign trade settlements, the use of cryptocurrencies by Russian companies has been suggested as a response to the economic sanctions imposed by the US, UK, and EU following the conflict in Ukraine. These sanctions prompted Russian firms to explore alternative payment methods to navigate the restrictions imposed on traditional financial channels.

Despite the potential benefits of crypto adoption for the Russian economy, the Central Bank remains cautious and opposed to widespread cryptocurrency use. The bank advocates for a controlled approach to crypto trading within its official sandbox, limiting the scope of crypto transactions for companies operating in Russia.

As the debate over crypto adoption continues in Moscow, there is growing support among domestic companies for a legal framework that would enable more firms to leverage cryptocurrencies for international trade. With the ruble’s stability potentially linked to crypto adoption, the Russian government faces a balancing act between regulatory control and economic growth in the evolving digital landscape.