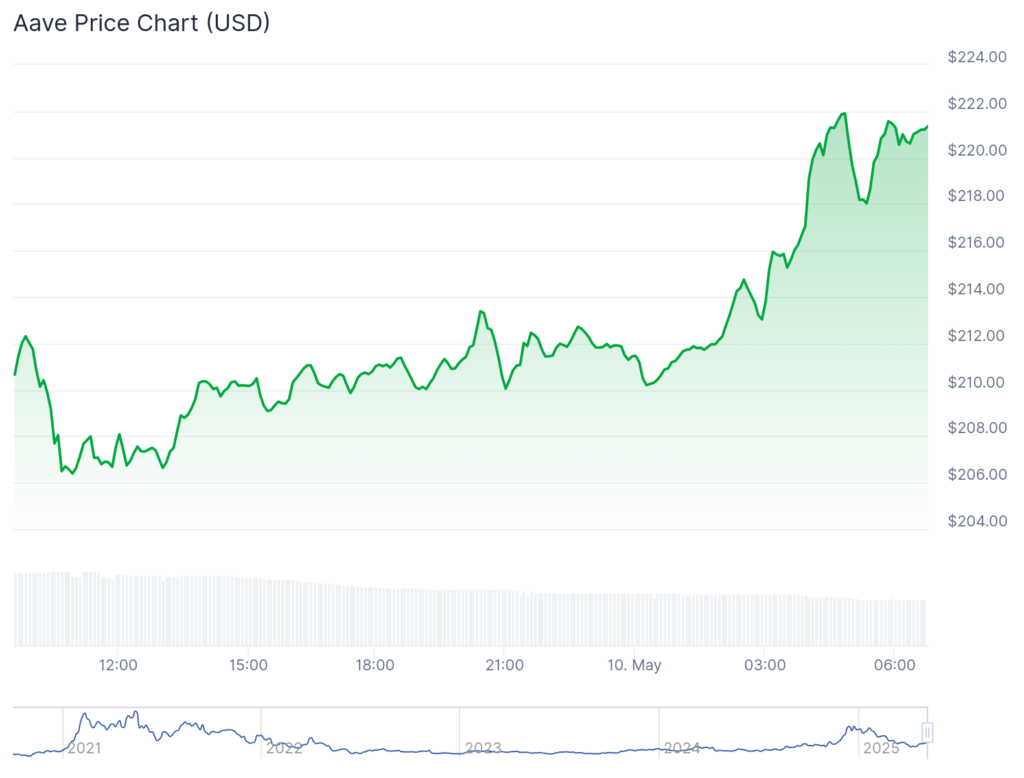

AAVE Price Surges to Highest Level Since March

Over the weekend, AAVE price continued its upward trajectory, reaching its highest level since March 6 as exchange balances fell and total value locked in its network decreased.

The price of AAVE (AAVE) surged to $221.91, marking a 95% increase from its lowest point on April 7 and pushing its market cap over $3.3 billion.

According to CoinGlass data, investors have been accumulating more AAVE tokens, particularly following Ethereum’s strong breakout and test of the key resistance level at $2,400 for the first time since February.

Exchange balances for AAVE dropped to 4.76 million from 4.87 million a week prior, reducing the total supply on exchanges to 29.74%. This decline in exchange balances indicates that holders are holding onto their AAVE tokens rather than selling, which is a positive sign for the coin.

The surge in AAVE price also solidified its position as a major player in the decentralized finance industry. Data from DeFi Llama shows that AAVE’s total value locked increased by 35% in the last 30 days to $24.2 billion, surpassing competitors like Lido (LDO) with $21.6 billion in assets.

This growth has made AAVE one of the most profitable players in the crypto market, with year-to-date fees reaching $224 million.

AAVE operates as a decentralized banking platform that allows users to earn interest on their idle assets through lending operations, offering competitive borrowing rates.

Technical Analysis of AAVE Price

On the daily chart, AAVE price hit a low of $113.50 on April 7 before rebounding to its highest level since March 6. It has surpassed the 50-day Exponential Moving Average and the key psychological level at $1,000.

The Relative Strength Index has reached the overbought territory at 75, while the MACD indicator has crossed above the zero line.

This upward trend followed the formation of a falling wedge pattern between December and April, suggesting that AAVE may continue to rise with bulls aiming for the key resistance level at $400, its peak in December.

A potential move to this level would represent an 83% increase from the current price. However, a drop below the support at $170 could invalidate this bullish outlook.