ETH Continues to Shine Brighter Than BTC

A recent analysis conducted by AMBCrypto has shed light on the growing trend of Ethereum outperforming Bitcoin in terms of long-term holder confidence. Data from IntoTheBlock reveals that the percentage of ETH holders who have retained their assets for over a year has surged from 59% in January 2024 to an impressive 75% by December 2024.

In stark contrast, Bitcoin has seen a decline in the proportion of long-term holders, dropping from 70% to 62.3% over the same period. This shift in investor behavior indicates a shifting sentiment in the market, with Ethereum gaining favor among investors for its potential future upgrades and broader utility.

Source: IntoTheBlock

The increasing retention rate for Ethereum is a testament to the growing confidence among investors, driven by the anticipation of upcoming network enhancements and the expanding use cases of the platform.

On the other hand, the decline in long-term Bitcoin holders may indicate profit-taking strategies or a shift towards diversification, signaling a potential change in market dynamics as investors pivot towards Ethereum as their preferred investment choice heading into 2025.

Crypto Fear and Greed Index Hits Two-Month Low

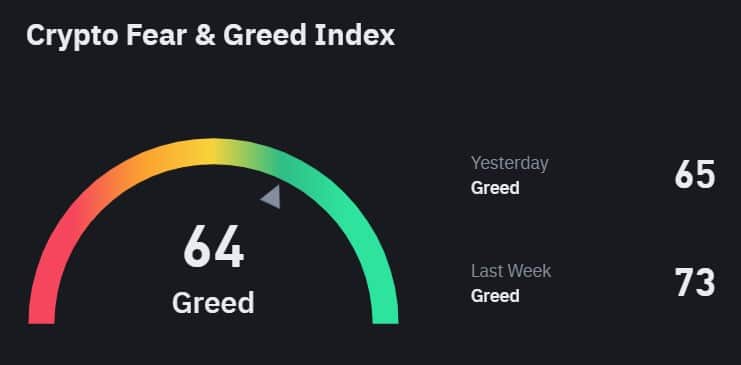

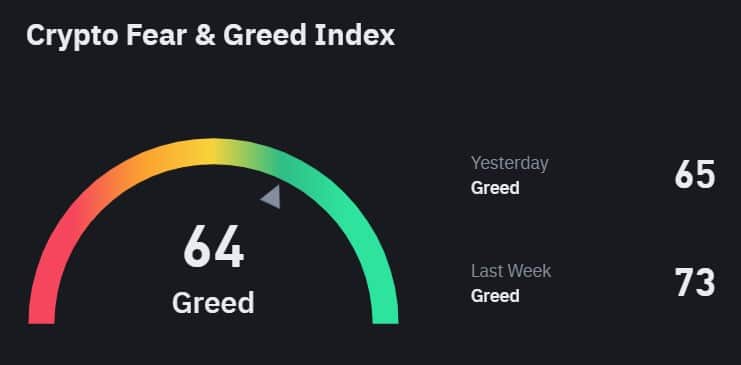

In addition to the shift in investor sentiment towards Ethereum, Bitcoin faced another challenge as its Crypto Fear and Greed Index dropped to 64 on the 31st of December, marking its lowest level since mid-October.

This decline in the index reflects a decline in market optimism as Bitcoin experienced a 12% drop in price over the past two weeks, hovering around $93,000.

Source: Binance Square

Following a peak of 94 in November fueled by the excitement surrounding the pro-crypto U.S. election results, the index remained above 70 for most of December before the recent drop. This shift indicates a move from extreme greed to a more cautious outlook among investors.

While greed still prevails in the market, the decrease in the index highlights growing concerns about short-term volatility as traders react to Bitcoin’s price fluctuations and the mixed signals from the broader market.

Read Ethereum [ETH] Price Prediction 2025-2026

Bitcoin Enters Accumulation Phase, Predicts Investor

Despite the recent downturn, investor James Williams believes that Bitcoin is entering a crucial accumulation phase. In a recent post on X (formerly Twitter), Williams emphasized the current market conditions as an opportunity for long-term positioning.

Williams forecasts a period of consolidation in the coming weeks, potentially paving the way for a significant breakout. Confident in Bitcoin’s long-term trajectory, Williams predicts a price target of $131,500 or higher by the first quarter of 2025, deeming such levels as “inevitable.”

He stresses the importance of patience during consolidation phases, as these periods historically precede substantial upward movements in Bitcoin’s price.