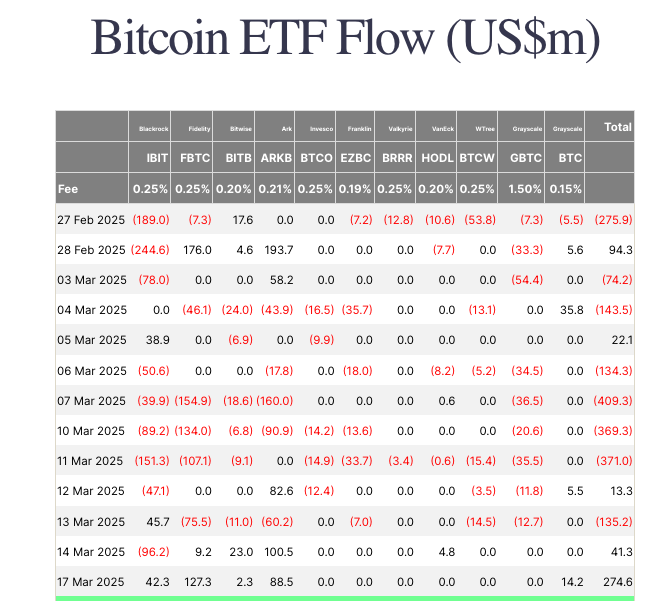

In March, US spot Bitcoin ETFs faced significant challenges, with over $1.6 billion in net outflows recorded as market uncertainty and broader economic concerns dampened investor sentiment. Data from Farside Investors revealed that most US spot Bitcoin ETFs experienced negative performances, resulting in total outflows exceeding $1.6 billion in the first 17 days of March.

The outflows far surpassed inflows, raising concerns about a potential prolonged downturn in Bitcoin prices. Asset management giant BlackRock’s iShares Bitcoin Trust ETF (IBIT) suffered the largest outflows of $552 million, while only attracting $84.6 million in inflows. Fidelity’s Wise Origin Bitcoin Fund (FBTC) also faced challenges, with $517 million in outflows compared to $136.5 million in inflows. Grayscale’s Bitcoin Trust ETF (GBTC) saw outflows exceeding $200 million without any recorded inflows. However, Grayscale’s Bitcoin Mini Trust ETF (BTC) managed to buck the trend with zero outflows and a net inflow of $55 million.

The negative trend extended beyond the major Bitcoin ETFs, affecting a range of investment products. Invesco Galaxy’s BTCO, Franklin Templeton’s EZBC, Bitwise’s BITB, and WisdomTree’s BTCW all experienced moderate outflows, ranging between $51 million and $116 million. Valkyrie’s BRRR and VanEck’s HODL fared slightly better with minor outflows under $15 million.

The decline in Bitcoin ETFs mirrored the struggles of Ethereum-based investment products, which also saw significant capital flight throughout March. BlackRock’s iShares Ethereum Trust ETF (ETHA) reported $126 million in outflows, while Fidelity’s Ethereum Fund (FETH) faced $73 million in outflows against $21 million in inflows.

Analysts attributed the price decline and outflows to broader economic concerns, including trade tariffs and overall market uncertainty. A CoinShares report highlighted a five-week liquidation streak resulting in $6.4 billion in total outflows across cryptocurrency exchange-traded products (ETPs). Despite the challenges, Bitcoin continued to outperform major asset classes according to Bloomberg data shared by Apollo Sats co-founder Thomas Fahrer.

The implications of sustained ETF outflows on the crypto markets remain to be seen, as industry players may need to adjust their offerings and strategies in response to evolving market conditions. The trends observed in ETF performance could provide valuable insights into future digital asset allocation and market dynamics.

Overall, the challenges faced by US spot Bitcoin ETFs in March underscore the volatile nature of the crypto market and the importance of monitoring external economic influences and investor behavior to navigate through uncertain times.